By: Ron Pernick

Quarterly overview of stock index performance and the top trends impacting the state of clean tech.

The major news in the first quarter of 2022 was Russia’s unprovoked and vicious attack on the sovereign nation of Ukraine – making Vladimir Putin a global pariah (if he wasn’t already) and comedian turned-president Volodymyr Zelensky an accidental hero for inspiring and galvanizing the courage and strength of millions. The brutal and unsettling attack has also laid bare Europe’s reliance on Russian coal, oil, and natural gas, and has many nations scrambling to put an end to their dependency on volatile fossil fuels and Putin’s petrostate dictatorship once and for all.

While the markets continued to reward fossil fuels in Q1 (high prices and post-pandemic demand both fueled record profits for oil companies), there’s a growing and palpable sense that Putin’s War, rather than hindering the energy transition, will likely accelerate renewables and electrification efforts. As I outline below in my latest quarterly insight, there are signs of hope that after decades of Russian fossil fuel dependency, Europe is finally working overtime to release itself from Putin’s stranglehold. Indeed, moving from fossil fuels to renewables achieves two overarching goals of the continent: climate resiliency and energy independence.

Reflecting the unpredictability and volatility facing markets (including inflationary pressures and a meteoric rise in fossil fuel pricing) during Q1, CELS (U.S. clean energy) declined 4.89% and GWE (global wind) was down 2.03%. Infrastructure-focused QGRD (global smart grid & grid infrastructure) and HHO (U.S. water) declined 7.75% and 10.88% respectively. During the same timeframe, the S&P 500 declined 4.6% and IXE (Energy Select) was up 39.08% for the quarter.

Q1 2022 Index Performance (Total Return)

As of March 31, 2022 (Total Return) | CELS (U.S. Clean Energy) | GWE (Global Wind) | HHO (U.S. Water) | QGRD (Global Grid) | S&P 500 | IXE (Energy Select) |

|---|---|---|---|---|---|---|

Q1 | -4.89% | -2.03% | -10.88% | -7.75% | -4.60% | 39.08% |

12-Month | -5.31% | -9.38% | 9.49% | 11.54% | 15.65% | 63.26% |

Over the past 12 months (total return basis through the end of March), CELS and GWE both declined, down 5.31% and 9.38% respectively. QGRD and HHO both increased, up 11.54% and 9.49% respectively, compared to the S&P 500’s 15.65% increase and IXE’s 63.26% increase.

Twelve-Month Index Performance (Total Return)

First Trust ETFs tracking Nasdaq Clean Edge indexes equaled more than $4 billion in assets under management as of April 2022.

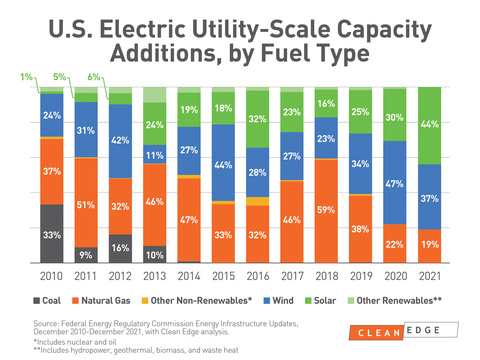

DATA DIVE: US ELECTRIC UTILITY-SCALE CAPACITY ADDITIONS, BY FUEL-TYPE

WINNERS AND LOSERS (INDEX CONSTITUENTS RANKED BY PRICE RETURN)

Below is a list of the top 10 best and worst constituent performers across Nasdaq Clean Edge indexes (CELS, QGRD, HHO, and GWE) during Q1 2022. Note: some of the best and worst constituents were added during the most recent semi-annual evaluation on March 21, 2022.

Best and Worst Constituents (Q1 2022)

Winners | Losers | ||

|---|---|---|---|

Sociedad Quimica y Minera de Chile S.A. | 69.74% | Fluence Energy, Inc. | -63.13% |

Companhia de Saneamento Basico do Estado de Sao Paulo-SABESP | 33.92% | Romeo Power, Inc. | -59.18% |

EVgo, Inc. | 29.38% | Volta, Inc. | -58.45% |

Infrastructure and Energy Alternatives, Inc. | 28.80% | XPeng, Inc. | -45.18% |

MP Materials Corp. | 26.24% | Vicor Corp. | -44.44% |

PNE AG | 21.49% | Eos Energy Enterprises, Inc. | -44.41% |

Energiekontor AG | 20.21% | Stem, Inc. | -41.96% |

Archaea Energy, Inc. | 19.97% | Niu Technologies | -40.04% |

Terna Energy S.A. | 19.51% | Navitas Semiconductor Corp. | -39.56% |

Boralex, Inc. | 19.13% | FTC Solar, Inc. | -34.79% |

QUARTERLY INSIGHT: OUT OF CRISIS COMES HOPE

The war in Ukraine, and the massive devastation inflicted by Putin, have left me on edge; I’ve been constantly checking the latest developments and donating to causes that might be able to help, even a little bit, on the ground. Having to witness such barbarity harkens back to humanity’s deeper, darker side (and echoes of Hitler’s invasions), in stark contrast to an optimistic vision of an advanced, collaborative future. But out of crisis can come unexpected leadership and hope. The following recent developments give me just that:

- Major Brands Pull out of Russia. Putting their proverbial and collective middle finger in Putin’s face, many of the world’s largest corporations, including oil companies, have made it clear how they feel about Russia’s invasion of Ukraine. In a move that would have been hard to fathom just months ago, hundreds of the world’s largest and most influential companies have either shuttered or suspended their operations in Russia including Airbnb, Apple, Chevron, Coca-Cola, Daimler, Exxon, Ford, Intel, Johnson Controls, Maersk, McDonalds, Netflix, Shell, and Visa. In a connected, always-on world, these brands have aligned themselves with investor and consumer fury at Russian atrocities. In the words of New York Times columnist Thomas Friedman, “Putin had no clue how many of us would be watching.” This is a very positive and 21st Century development. See: https://som.yale.edu/story/2022/over-600-companies-have-withdrawn-russia-some-remain

- The Death of Nord Stream 2. For years, many Germans knew that their country’s reliance on Russian natural gas would likely come back to haunt them, but under the leadership of former Chancellor Angela Merkel the country moved forward with the build-out of the Nord Stream 2 gas pipeline, in hopes of doubling Russian natural gas imports via the Nord Stream system. It took Putin’s Ukraine attack to finally awaken German leaders to the fact that the deal was a geopolitical nightmare. Just days into the war, newly elected German Chancellor Olaf Scholz ended years of German government support for the new pipeline. And the Biden Administration imposed sanctions on Nord Stream AG 2, the Russian-owned, Swiss-based parent company of the pipeline (which has now subsequently terminated worker contracts and is reportedly in bankruptcy). Germany will have to work hard to find alternatives to this gas, but don’t expect the pipeline, which cost around $11 billion to build, to ever be utilized. With increasingly devastating attacks on Ukraine coming from Russia, both the U.S. and Germany have made it clear that the pipeline will never become operational. See: https://crsreports.congress.gov/product/pdf/IF/IF11138

- Solar, Wind, Storage, and Green Hydrogen Go into Hyperdrive. Solar and wind are now the most cost-effective forms of new electricity capacity additions. As we reported earlier this month, the U.S. received more than 80% of new capacity additions from solar and wind power in 2021. Globally, renewable energy (solar, wind, and hydropower) continued to dominate global capacity additions as well, contributing 81% in 2021, according to the International Renewable Energy Agency. In the most recent Intergovernmental Panel on Climate Change report, the UN organization finds that building wind and solar is the most impactful and cheapest way to keep temperatures to 1.5C. Paired with storage and electrification of transportation and heating (e.g., heat pumps), renewable energy is poised to help Europe hypercharge its transition efforts. And because of natural gas price increases, green hydrogen efforts are now poised to pencil out years ahead of earlier projections. It’s hard to assess the full ramifications of Russia’s aggression on the future of energy in Europe, but we expect it to be a significant driver in weaning the continent off Russian gas in a much-accelerated pathway. Earlier this month, EU’s climate policy chief intimated that there would likely be an expansion of EU renewable energy and green hydrogen goals due to Putin’s actions. We’ll be watching. See: https://www.reuters.com/business/energy/eu-could-revisit-renewable-targets-push-quit-russian-energy-timmermans-2022-04-10/

Disclaimer:

The information contained above is provided for informational and educational purposes only. Clean Edge is not an investment adviser, and none of the information, including any Nasdaq Clean Edge index, should be construed as investment advice or relied on as the basis for making any kind of investment decision. Neither Clean Edge nor any of its affiliates makes any recommendation whatsoever to buy or sell any securities, fund, or financial product or any representation about the financial condition of any company, fund, or financial product. Information regarding any Clean Edge index is not a guarantee of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results and should never be relied upon for making any kind of investment decisions. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.