No timeline selected.

CELS Overview

The Nasdaq Clean Edge Green Energy™ Index (CELS™) is a modified market capitalization-weighted index designed to track the performance of companies that are manufacturers, developers, distributors, and/or installers of clean-energy technologies.

An alternate version of the index, the Nasdaq Clean Edge Green Energy Exclusions™ Index (CELSE™), incorporates an ESG screening methodology identified and applied by Morningstar Sustainalytics. Click on the Constituents Sheet to learn more.

See index constituents and learn more about recent index performance, licensed financial products, and methodologies below.

CELS Constituents

(Last updated September 2025)

| TICKER | COMPANY NAME | SECTOR | DOMICILE | |

|---|---|---|---|---|

| AYI | Acuity, Inc. | EI | USA | |

| AEIS | Advanced Energy Industries, Inc. | ES&C | USA | |

| ALB | Albemarle Corp. | AM | USA | |

| ALGM | Allegro MicroSystems, Inc. | EI | USA | |

| AMRC | Ameresco, Inc. | EI + RE | USA | |

| AMSC | American Superconductor Corp. | EI | USA | |

| ARRY | Array Technologies, Inc. | RE | USA | |

| ASPN | Aspen Aerogels, Inc. | ES&C + EI | USA | |

| BLDP | Ballard Power Systems, Inc. | ES&C | Canada | |

| BE | Bloom Energy Corp. | ES&C | USA |

See All Constituents

| TICKER | COMPANY NAME | SECTOR | DOMICILE |

|---|---|---|---|

| BEP | Brookfield Renewable Partners L.P. | RE | Bermuda |

| CHPT | ChargePoint Holdings, Inc. | ES&C | USA |

| CLNE | Clean Energy Fuels Corp. | AM | USA |

| CWEN | Clearway Energy, Inc. | RE | USA |

| ELVA | Electrovaya, Inc. | ES&C | Canada |

| ENS | EnerSys | ES&C | USA |

| ENVX | Enovix Corporation | ES&C | USA |

| ENPH | Enphase Energy, Inc. | ES&C | USA |

| EOSE | Eos Energy Enterprises, Inc. | ES&C | USA |

| EVGO | EVgo, Inc. | ES&C | USA |

| FSLR | First Solar, Inc. | RE | USA |

| FLNC | Fluence Energy, Inc. | ES&C | USA |

| GEVO | Gevo, Inc. | AM | USA |

| HASI | HA Sustainable Infrastructure Capital, Inc. | RE + EI | USA |

| ITRI | Itron, Inc. | EI | USA |

| LYTS | LSI Industries, Inc. | EI | USA |

| LCID | Lucid Group, Inc. | ES&C | USA |

| MNTK | Montauk Renewables, Inc. | AM | USA |

| MP | MP Materials Corp. | AM | USA |

| NVTS | Navitas Semiconductor Corp. | EI + ES&C | USA |

| NXT | Nextracker, Inc. | RE | USA |

| ON | ON Semiconductor Corp. | EI + ES&C | USA |

| ORA | Ormat Technologies, Inc. | RE | USA |

| PLUG | Plug Power, Inc. | ES&C | USA |

| PSNY | Polestar Automotive Holding UK Plc | ES&C | USA |

| POWI | Power Integrations, Inc. | EI + ES&C | USA |

| RNW | ReNew Energy Global Plc | RE | India |

| RIVN | Rivian Automotive, Inc. | ES&C | USA |

| SHLS | Shoals Technologies Group, Inc. | RE | USA |

| SGML | Sigma Lithium Corporation | AM | Brazil |

| SQM | Sociedad Química y Minera de Chile S.A. | AM | Chile |

| SEDG | SolarEdge Technologies, Inc. | EI | Israel |

| RUN | Sunrun, Inc. | RE + ES&C | USA |

| TSLA | Tesla, Inc. | ES&C + RE | USA |

| OLED | Universal Display Corp. | EI | USA |

| VICR | Vicor Corp. | EI + ES&C | USA |

| WLDN | Willdan Group, Inc. | EI | USA |

| WOLF | Wolfspeed, Inc. | EI + ES&C | USA |

| XIFR | XPLR Infrastructure, L.P. | RE | USA |

Licensed Financial Products

Linked products include the following.

| NAME | SYMBOL | SPONSOR |

|---|---|---|

| First Trust NASDAQ® Clean Edge® Green Energy Index Fund | QCLN | First Trust Advisors L.P. |

| First Trust Nasdaq® Clean Edge® Green Energy UCITS ETF | QCLU | First Trust Global Portfolios |

| Samsung KODEX US Clean Energy Nasdaq ETF | 419420 KS | Samsung Asset Management |

For additional information on licensing opportunities, please contact us.

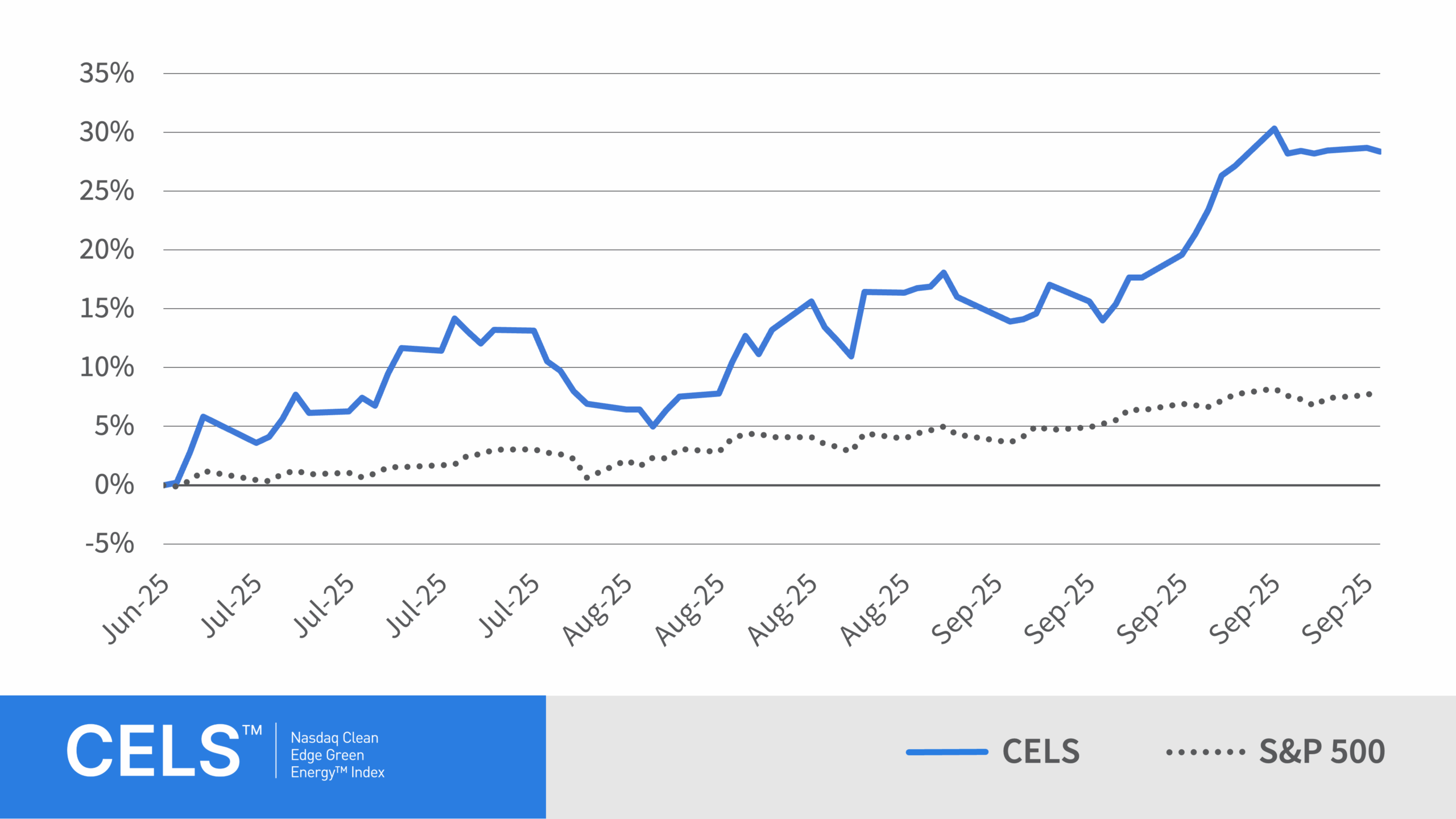

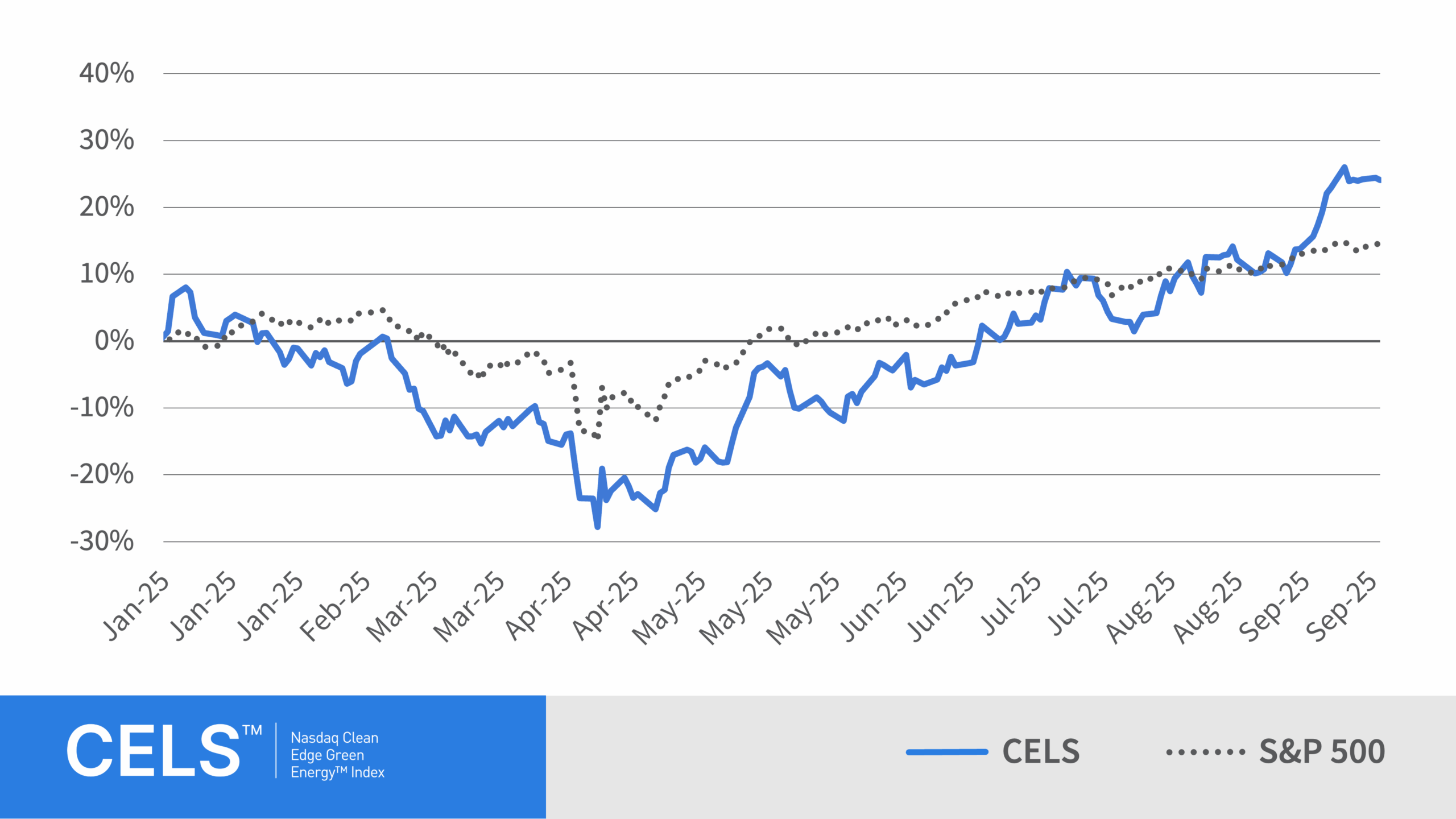

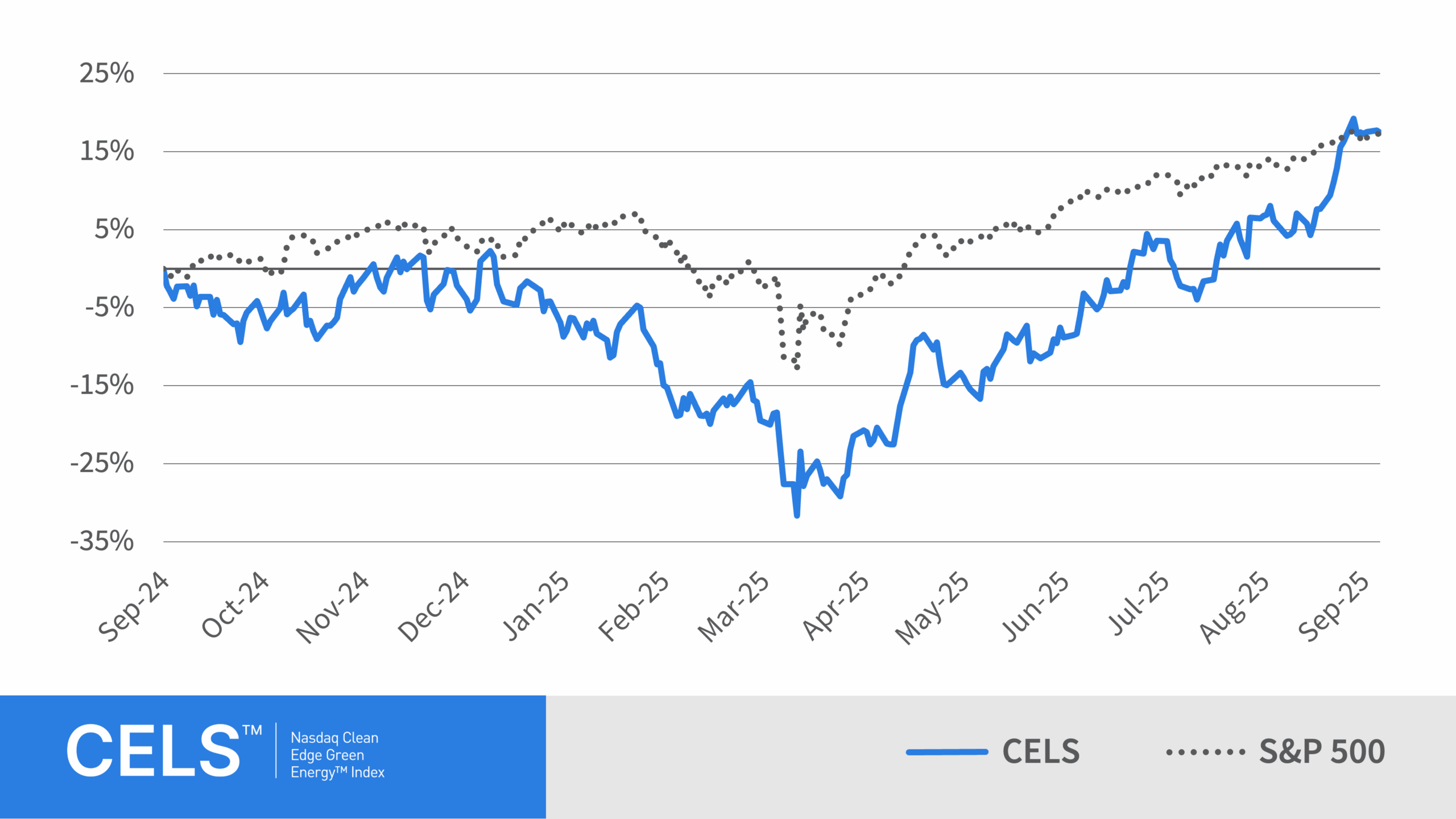

Recent CELS Index Performance

Total Return Through September 30, 2025

CELS Methodology

Index Calculation

The Nasdaq Clean Edge Green Energy Index (CELS) began on November 17, 2006, at a Base Value of 250.00. Click here to learn more.

Eligibility Criteria

To be eligible for inclusion in the Index, issuers of a security must be classified, according to Clean Edge, as technology manufacturers, developers, distributors, and/or installers in one or more of the following sub-sectors (see complete list of index screens by clicking on the Methodology link below):

- Advanced Materials (silicon, lithium, bio-based, and/or other materials and processes that enable clean- energy and low-carbon technologies);

- Energy Intelligence (conservation, efficiency, smart meters, energy management systems, LEDs, smart grid, superconductors, power controls, etc.);

- Energy Storage & Conversion (advanced batteries, power conversion, electric vehicles, hybrid drivetrains, hydrogen, fuel cells for stationary, portable, and transportation applications, etc.); and

- Renewable Electricity Generation (solar, wind, geothermal, water power, etc.).

A security’s issuer must be determined by Clean Edge to have a demonstrated ability to capture the potential of the clean-energy sector by receiving a majority (50% or more) of its revenue from clean-energy and low-carbon activities, or, in the case wherein a company has multiple business units and revenue streams, have substantial exposure to the clean-energy and low-carbon sector.

In addition, a security must pass the following screens:

- be listed on the Nasdaq Stock Market, the New York Stock Exchange, NYSE American, or the Cboe BZX Exchange;

- have a minimum market capitalization of $150 million;

- have a minimum average daily trading volume of at least 100,000 shares;

- have a minimum closing price of $1.00;

- the issuer of the security may not have entered into a definitive agreement or other arrangement which would likely result in the security no longer being Index-eligible;

- may not be issued by an issuer currently in bankruptcy proceedings; must not be identified by the U.S. Securities and Exchange Commission (SEC) as having used to audit its financial statements an accounting firm that has been identified by the Public Company Accounting Oversight Board (PCAOB) under the Holding Foreign Companies Accountable Act (HFCAA).