No timeline selected.

GHHO Overview

The Nasdaq Clean Edge Global Water™ Index (GHHO™) is a modified equal-weighted Index designed to track the performance of companies that derive a substantial portion of their revenues from the potable water and wastewater industry, as defined by Clean Edge. Industry exposure includes water distribution, infrastructure (pumps, pipes, and valves), water solutions (purification and filtration), and ancillary services such as consulting, construction, and metering. Companies are also evaluated on the basis of their business activities, controversies, and ESG Risk Ratings.

See index components and learn more about up-to-date performance, licensed financial products, and our methodologies below.

GHHO Constituents

(Last updated September 2025)

| TICKER | COMPANY NAME | SECTOR | DOMICILE | |

|---|---|---|---|---|

| AOS | A. O. Smith Corp. | WI | USA | |

| ABBN | ABB Ltd. | AP&S | Switzerland | |

| ANA | Acciona S.A. | AP&S | Spain | |

| WMS | Advanced Drainage Systems, Inc. | WI | USA | |

| ACM | AECOM | AP&S | USA | |

| A | Agilent Technologies, Inc. | T&T | USA | |

| AQN | Algonquin Power & Utilities Corp. | U&D | Canada | |

| AWK | American Water Works Co., Inc. | U&D | USA | |

| ARCAD | Arcadis N.V. | AP&S | Netherlands | |

| ADSK | Autodesk, Inc. | AP&S | USA |

See All Constituents

| TICKER | COMPANY NAME | SECTOR | DOMICILE |

|---|---|---|---|

| BMI | Badger Meter, Inc. | AP&S | USA |

| BSY | Bentley Systems, Inc. | AP&S | USA |

| SBSP3 | Companhia de Saneamento Básico do Estado de São Paulo S.A. | U&D | Brazil |

| CNM | Core & Main, Inc. | WI | USA |

| 021240 | Coway Co., Ltd. | U&D | Korea |

| ECL | Ecolab, Inc. | T&T | USA |

| WTRG | Essential Utilities, Inc. | U&D | USA |

| ERF | Eurofins Scientific SE | T&T | France |

| FERG | Ferguson Enterprises, Inc. | WI | USA |

| FBIN | Fortune Brands Innovations, Inc. | WI | USA |

| FELE | Franklin Electric Co., Inc. | WI | USA |

| GEBN | Geberit AG | WI | Switzerland |

| GF | Georg Fischer AG | WI | Switzerland |

| IEX | IDEX Corp. | WI | USA |

| IDXX | IDEXX Laboratories, Inc. | T&T | USA |

| ITRI | Itron, Inc. | AP&S | USA |

| J | Jacobs Solutions, Inc. | AP&S | USA |

| KEMIRA | Kemira Oyj | T&T | Finland |

| 6370 | Kurita Water Industries Ltd. | T&T | Japan |

| MAS | Masco Corporation | WI | USA |

| MLI | Mueller Industries, Inc. | WI | USA |

| MWA | Mueller Water Products, Inc. | WI | USA |

| PNR | Pentair Plc | WI | UK |

| PRMB | Primo Brands Corp. | U&D | USA |

| ROP | Roper Technologies, Inc. | AP&S | USA |

| SU | Schneider Electric SE | AP&S | France |

| SVT | Severn Trent Plc | U&D | UK |

| STN | Stantec, Inc. | AP&S | Canada |

| SUN | Sulzer AG | WI | Switzerland |

| TTEK | Tetra Tech, Inc. | AP&S | USA |

| 3402 | Toray Industries, Inc. | T&T | Japan |

| UU | United Utilities Group Plc | U&D | UK |

| VMI | Valmont Industries, Inc. | WI | USA |

| VLTO | Veralto Corp. | T&T | USA |

| WAT | Waters Corp. | T&T | USA |

| WTS | Watts Water Technologies, Inc. | WI | USA |

| WIE | Wienerberger AG | WI | Austria |

| WSP | WSP Global, Inc. | AP&S | Canada |

| XYL | Xylem, Inc. | AP&S | USA |

| ZWS | Zurn Elkay Water Solutions Corp. | WI | USA |

Licensed Financial Products

Linked products include the following.

| NAME | SYMBOL | SPONSOR |

|---|---|---|

| First Trust Nasdaq® Clean Edge® Global Water UCITS ETF | H2O | First Trust Global Portfolios |

For additional information on licensing opportunities, please contact us.

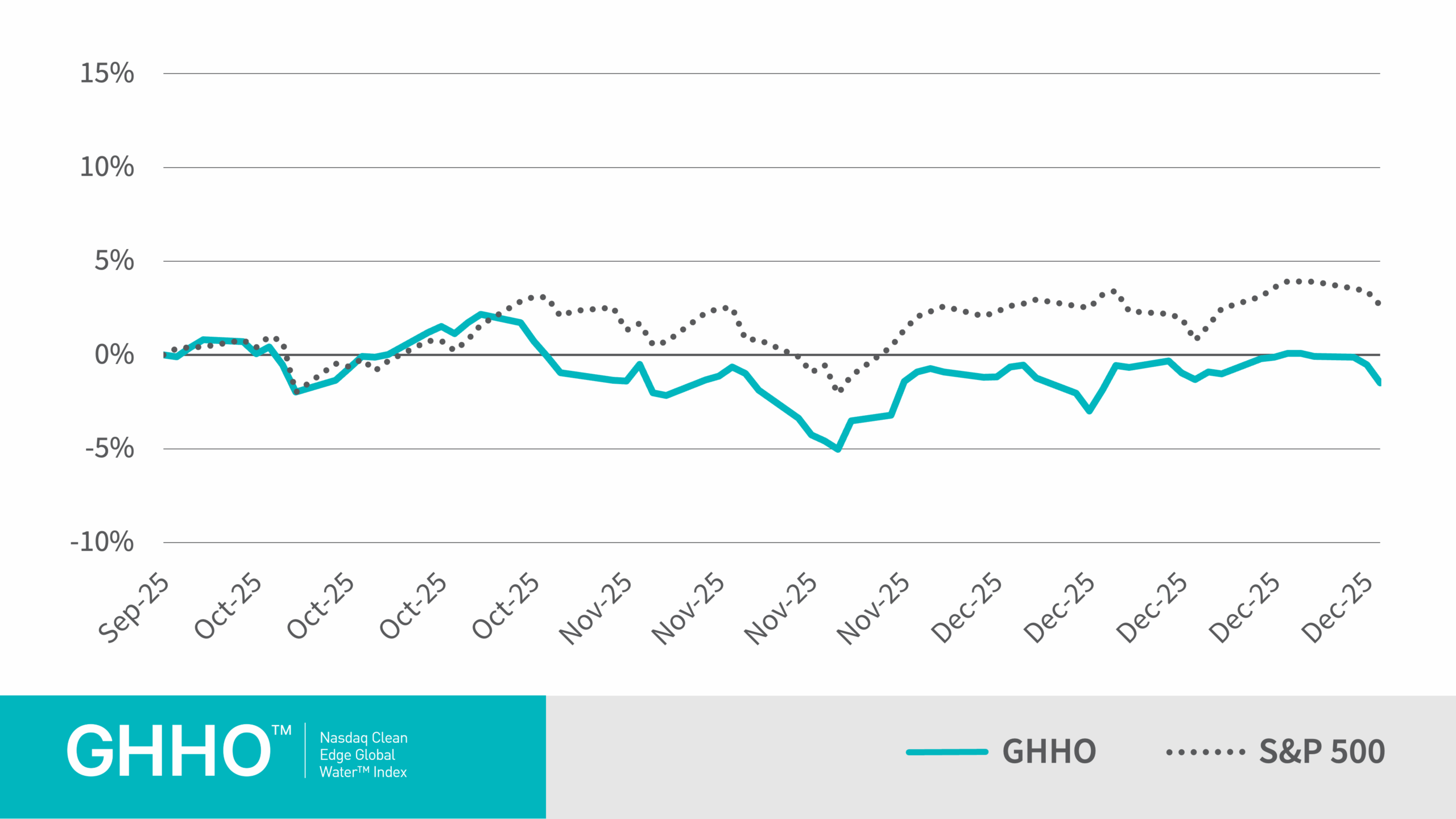

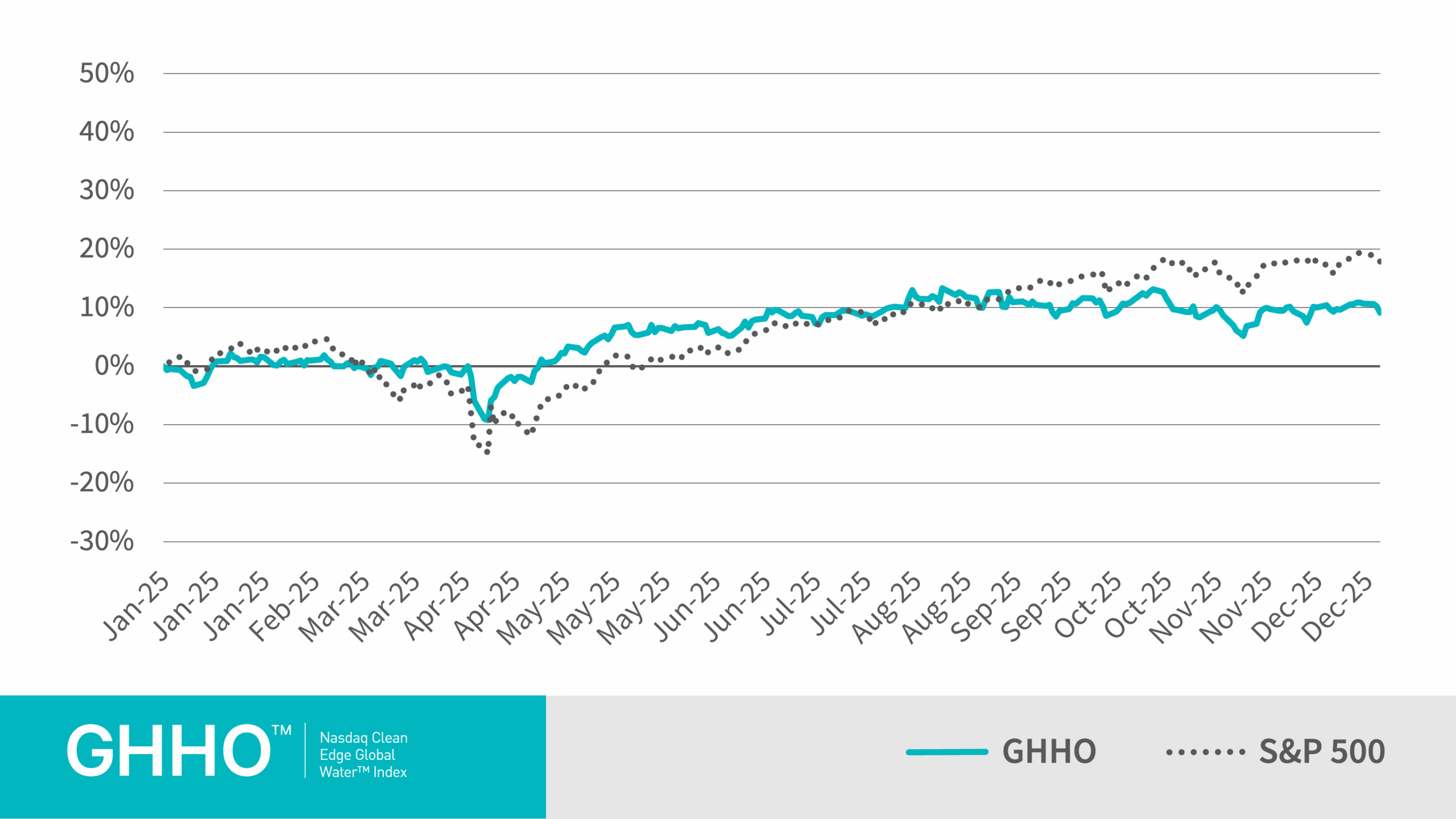

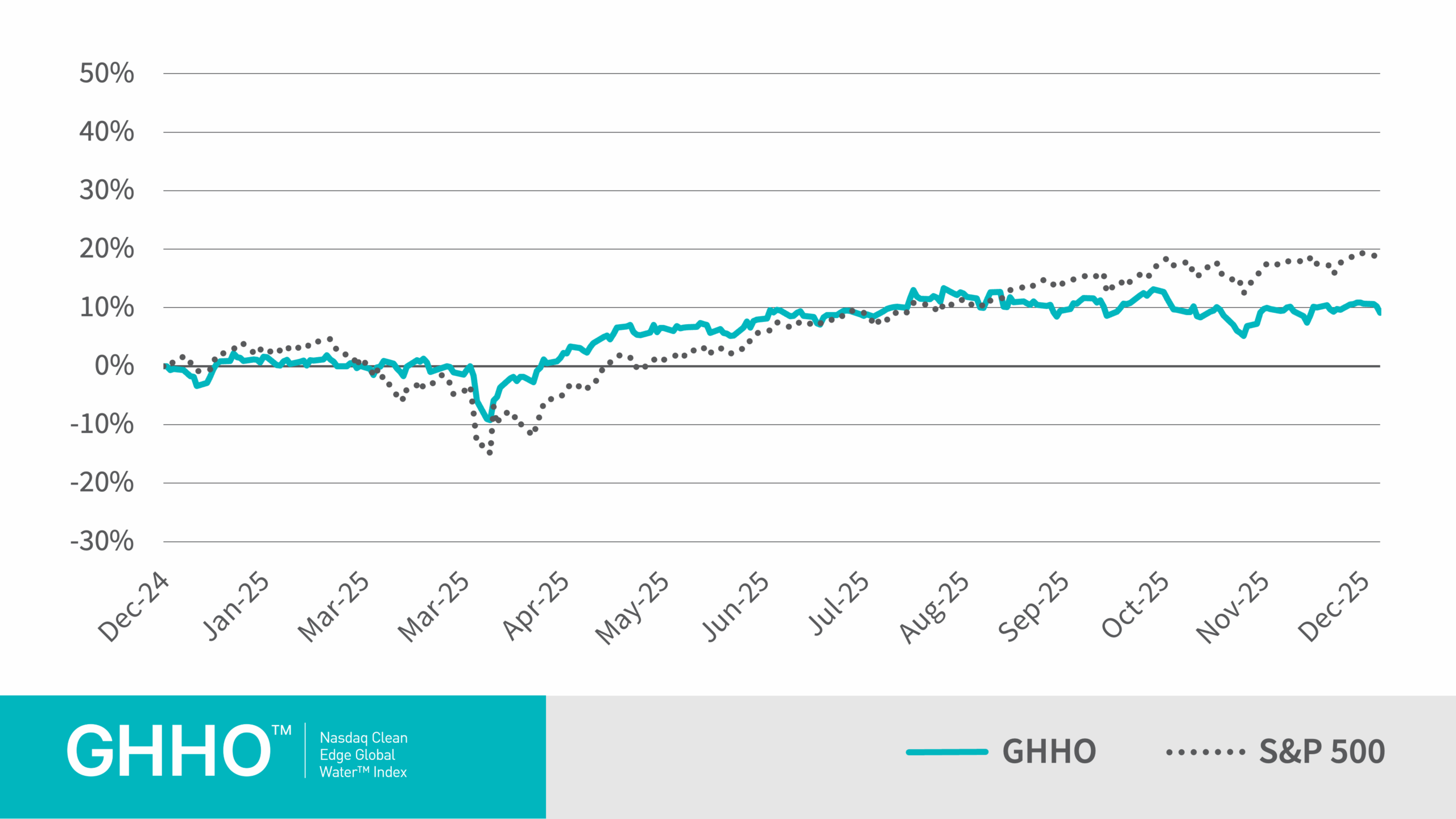

Recent GHHO Index Performance

Total Return Through December 31, 2025

GHHO Methodology

Index Calculation

The Nasdaq Clean Edge Global Water™ Index (GHHO) began on October 21, 2024 at a base value of 1,000.00. Click here to learn more.

Eligibility Criteria

To be eligible for inclusion in the Index, a security must meet the following criteria (see complete list of index screens by clicking on the Methodology link below):

- security’s issuer must derive a portion of their revenues from the water distribution, infrastructure, water solutions, and ancillary services industries, according to Clean Edge;

- a security must be listed on an Index-eligible exchange;

- eligible security types generally include common stocks, ordinary shares, and depositary receipts. Preferred shares and units are also eligible for securities listed in Brazil;

- a minimum market capitalization of at least $500 million (USD);

- a minimum free float of 20%;

- three-month average daily value traded (ADVT) of at least $3 million (USD);

- one security per issuer is permitted;

- have “seasoned” for at least three full calendar months, not including the month of initial listing;

- have passed a five-point screen by Morningstar Sustainalytics;

- the issuer of the security may not have entered into a definitive agreement or other arrangement which would likely result in the security no longer being Index-eligible;

- may not be issued by an issuer currently in bankruptcy proceedings.

Clean Edge categorizes each eligible company as Pure Play or Diversified. Pure Play companies are those that derive a substantial amount (50% or more) of revenue from water sector activities. All other companies are defined as Diversified.

Index Security weights are assigned according to the following modified equal weight approach:

- Diversified: Index Securities are equally weighted so that Diversified securities make up 20% of the index weight.

- Pure Play: Index Securities are equally weighted so that Pure Plays make up 80% of the index weight.