No timeline selected.

GGINC Overview

The Nasdaq Clean Edge Global Green Income™ Index (GGINC™) is designed to track the performance of 50 companies within the global green economy that have a consistent history of offering dividends and exhibit the highest trailing-twelve-months dividend yield.

See the top 10 constituents and learn more about up-to-date performance and index methodologies below.

Top 10 Constituents

(Last updated October 31, 2025)

| TICKER | COMPANY NAME | SECTOR | DOMICILE | INDEX WEIGHT |

|---|---|---|---|---|

| AWK | American Water Works Co., Inc. | 3.67% | ||

| 1211 (Hong Kong) | BYD Co. Ltd. | canada | 7.28% | |

| SBSP3 (São Paulo) | Companhia de Saneamento Básico do Estado de São Paulo S.A. | canada | 3.60% | |

| EOAN (Xetra) | E.ON SE | GI + EMD&N | Germany | 3.94% |

| EQIX | Equinix, Inc. | 8.60% | ||

| H (Toronto) | Hydro One Ltd. | 4.07% | ||

| IBE (Madrid) | Iberdrola S.A. | canada | 8.53% | |

| NG (London) | National Grid Plc | 8.30% | ||

| PLD | Prologis, Inc. | canada | 8.63% | |

| VIE (Paris) | Veolia Environnement S.A. | 3.87% |

For information on licensing opportunities, please contact us.

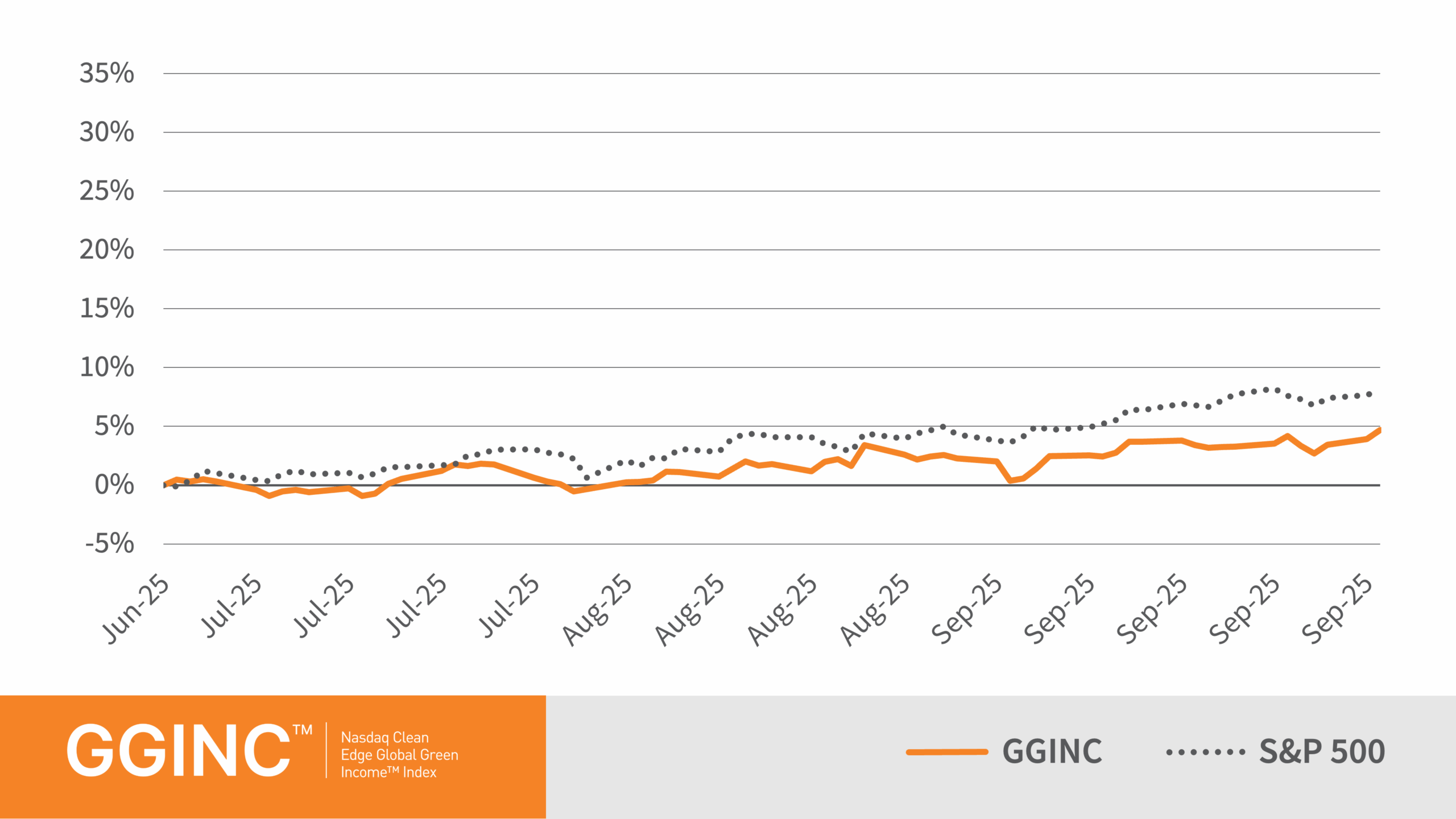

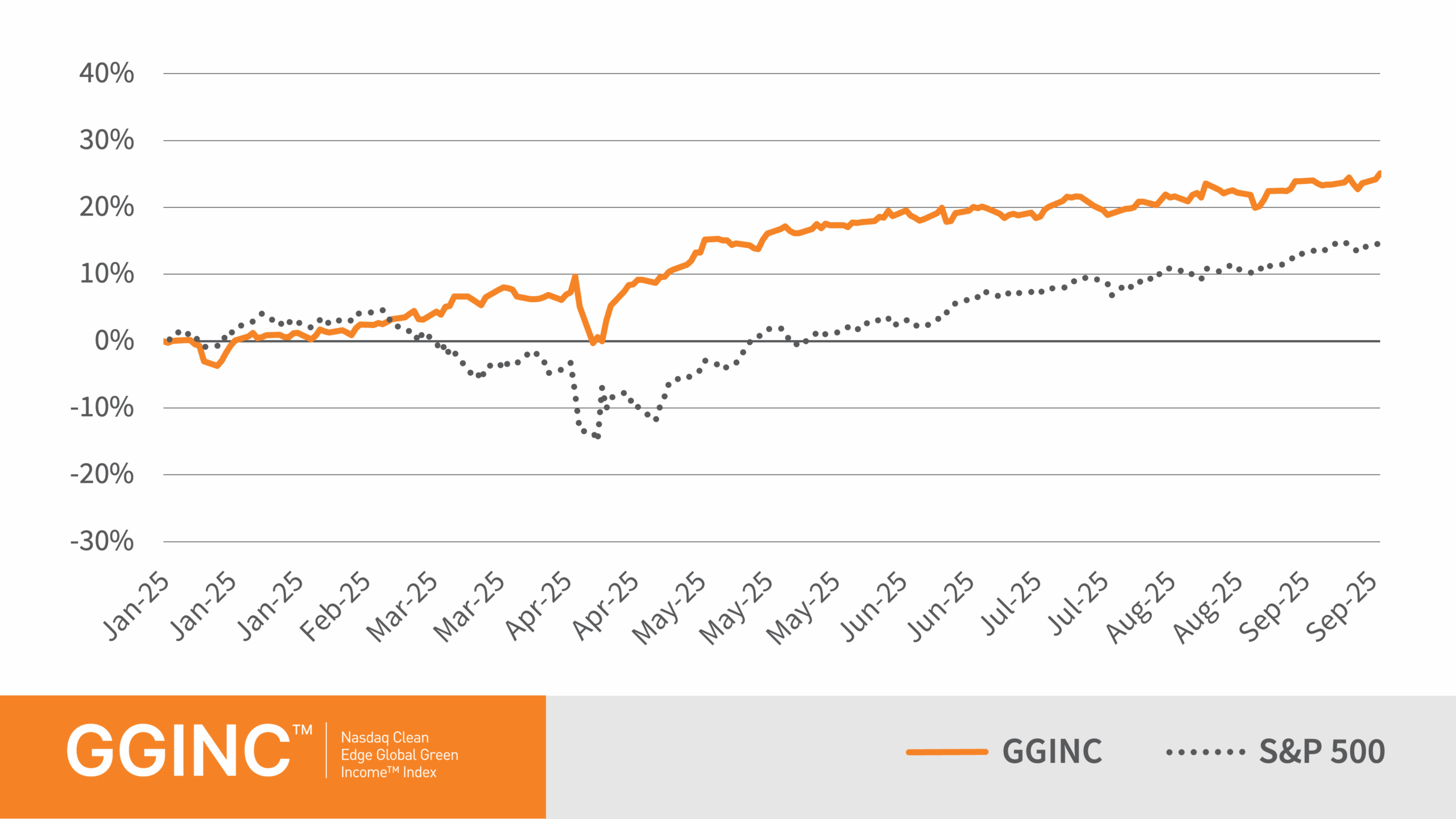

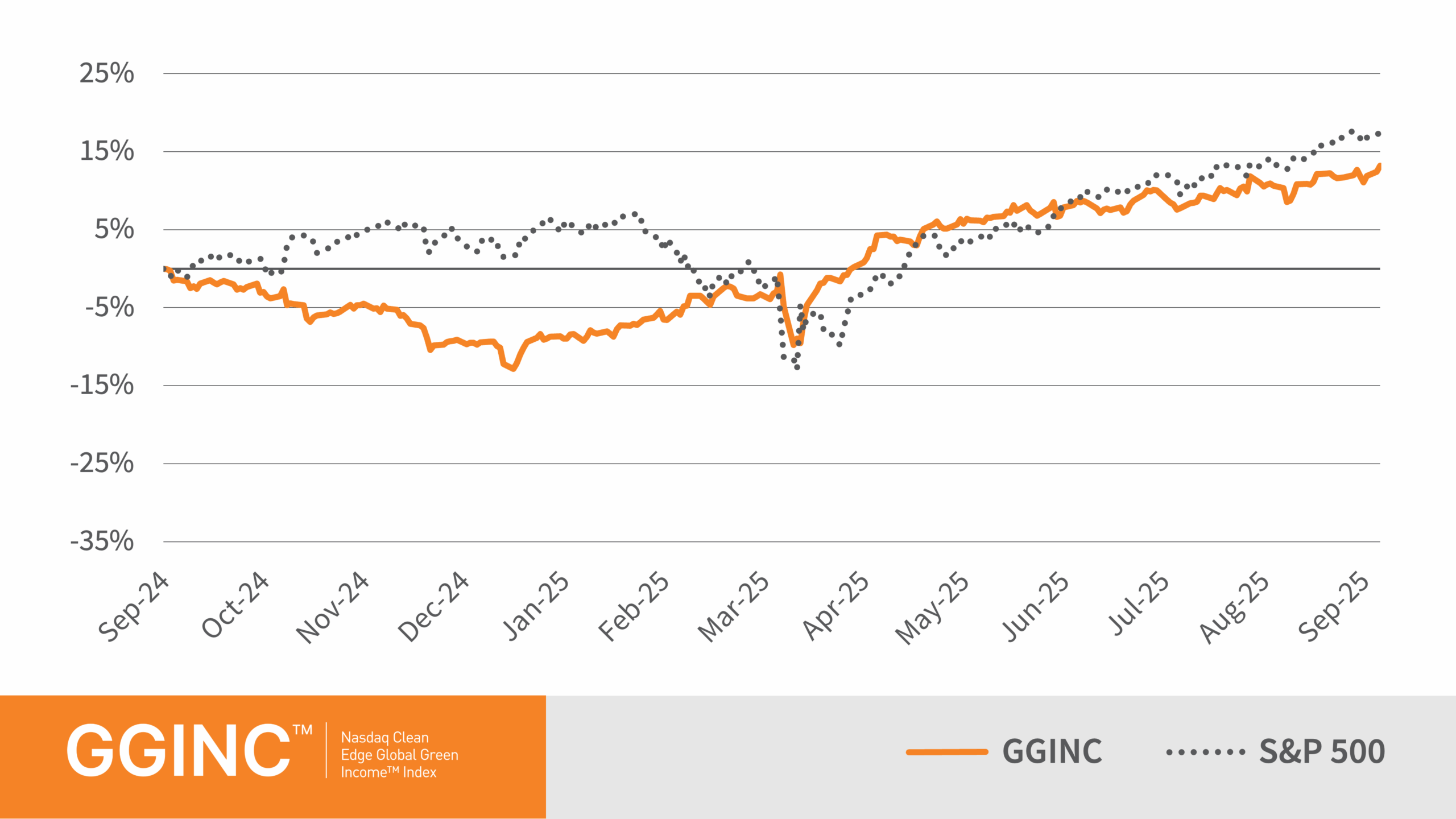

Recent GGINC Index Performance

Total Return Through September 30, 2025

GGINC Methodology

Index Calculation

Nasdaq Clean Edge Global Green Income Index (GGINC) began on February 13, 2023, at a Base Value of 1,000. Click here to learn more.

Eligibility Criteria

To be eligible for inclusion in the Index, security’s issuer must be classified by Clean Edge as a Green Economy company, specifically as belonging to one of either Electric Utilities, Water Utilities, Sustainable Infrastructure Developers & Technology Providers, Waste Management, Yieldcos, Investment Trusts and Similar Vehicles, Real Estate Investment Trusts (REITs) or Technology Providers (see complete list of index screens by clicking on the Methodology link below.)

The classifications are defined as follows:

Technology Providers – Technology providers in clean energy, energy efficiency, green buildings, advanced grid & electrification, low-carbon agriculture, water, waste management, and other green/sustainable infrastructure markets qualify for the universe. Technology providers must receive a majority (50% or more) of their revenue from one or more of the above sectors, “or,” in the case where a constituent has multiple business units and revenue streams, have substantial exposure to clean energy, energy efficiency, green buildings, advanced grid & electrification, low-carbon agriculture, water, waste management, and/or green/sustainable infrastructure markets according to Clean Edge.

Electric Utilities – Electric utilities have activities in power generation and/or transmission and distribution (“T&D”). Companies meeting the following requirements qualify for the universe.

Power -producing utilities must derive at least 50% of revenue from renewable sources, which we define as wind, solar, hydro and geothermal energies. In the instances in which revenue is not clearly delineated, reported power produced (watt-hours) from renewable sources must be greater than 50% of electrical generation.

T&D utilities must derive at least 50% of revenue from the transmission and distribution of electricity from renewable and non-emitting sources (e.g., existing nuclear power plants).

Utilities with both power-producing and T&D activities must derive at least 50% of combined revenues/generation from renewable and/or non-emitting sources according to the definitions described above.

Water Utilities – Water utilities that derive 50% or more of their revenue and/or operating profit from water and/or wastewater activities qualify for the universe. Utilities with multiple business units and revenue streams (such as water and electricity), must demonstrate substantial exposure to water and wastewater activities according to Clean Edge.

Sustainable Infrastructure Developers & Technology Providers – Sustainable infrastructure developers building and installing systems and facilities for clean electricity, water, energy efficiency, electrification, climate-adaptive agriculture, and low-carbon/zero-energy buildings qualify for the universe. Developers must receive a majority (50% or more) of their revenue from one or more of the above sectors, “or,” in the case where a constituent has multiple business units and revenue streams, have substantial exposure to clean electricity, water, energy efficiency, electrification, climate-adaptive agriculture, and/or low-carbon/zero-energy buildings according to Clean Edge.

Waste Management – 50% of revenue must result from activities in collecting trash and recyclable waste from homes and businesses; operating materials recovery facilities; operating organics processing facilities; and/or operating landfills where, in many cases, the gas generated by decomposing waste is processed into renewable energy.

Yieldcos, Investment Trusts and Similar Vehicles – Yieldcos, investment trusts, and/or similar vehicles that derive at least 50% of revenue from one or more activities in clean energy, energy efficiency, green buildings, advanced grid & electrification, low-carbon agriculture, water, waste management, and other green/sustainable infrastructure markets qualify for the universe.

Real Estate Investment Trusts (REITs) – To qualify for the universe, Clean Edge has determined the following process: REITs are evaluated using information on 1) emissions and 2) consumption of energy from renewable sources as reported by the company. First, an analysis locates a REIT’s emissions intensity position – as defined by Clean Edge – within the REIT research universe. “Emissions intensity” is defined as the sum of Scope 1 and Scope 2 emissions divided by annual revenues. To qualify, a REIT’s emission intensity scores must be at or below the median within the REIT research universe. Next, Clean Edge examines the resulting pool of REITs for consumption of energy from renewable sources as reported per disclosures meeting the Sustainable Finance Disclosure Regulations (SFDR) or corporate reports. Use of energy from renewable resources must be at least 90% of total use.