No timeline selected.

CELSI Overview

The Nasdaq Clean Edge International Green Energy™ Index (CELSI™) is designed to track the performance of non-US-based companies that are manufacturers, developers, distributors, and/or installers of clean-energy technologies, as classified by Clean Edge.

See the top 10 constituents and learn more about up-to-date performance and index methodologies below.

Top 10 Constituents

(Last updated October 31, 2025)

| TICKER | COMPANY NAME | SECTOR | DOMICILE | INDEX WEIGHT |

|---|---|---|---|---|

| ABBN (Swiss) | ABB Ltd. | canada | 8.04% | |

| 1211 (Hong Kong) | BYD Co. Ltd. | canada | 3.20% | |

| EOAN (Xetra) | E.ON SE | canada | 3.79% | |

| IBE (Madrid) | Iberdrola S.A. | canada | 7.83% | |

| NG (London) | National Grid Plc | canada | 7.74% | |

| PRY (Milan) | Prysmian S.p.A. | canada | 4.08% | |

| SU (Paris) | Schneider Electric SE | canada | 8.39% | |

| ENR (Xetra) | Siemens Energy AG | canada | 8.47% | |

| VWS (Copenhagen) | Vestas Wind Systems A/S | canada | 2.65% | |

| 9868 (Hong Kong) | Xpeng, Inc. | canada | 2.29% |

For information on licensing opportunities, please contact us.

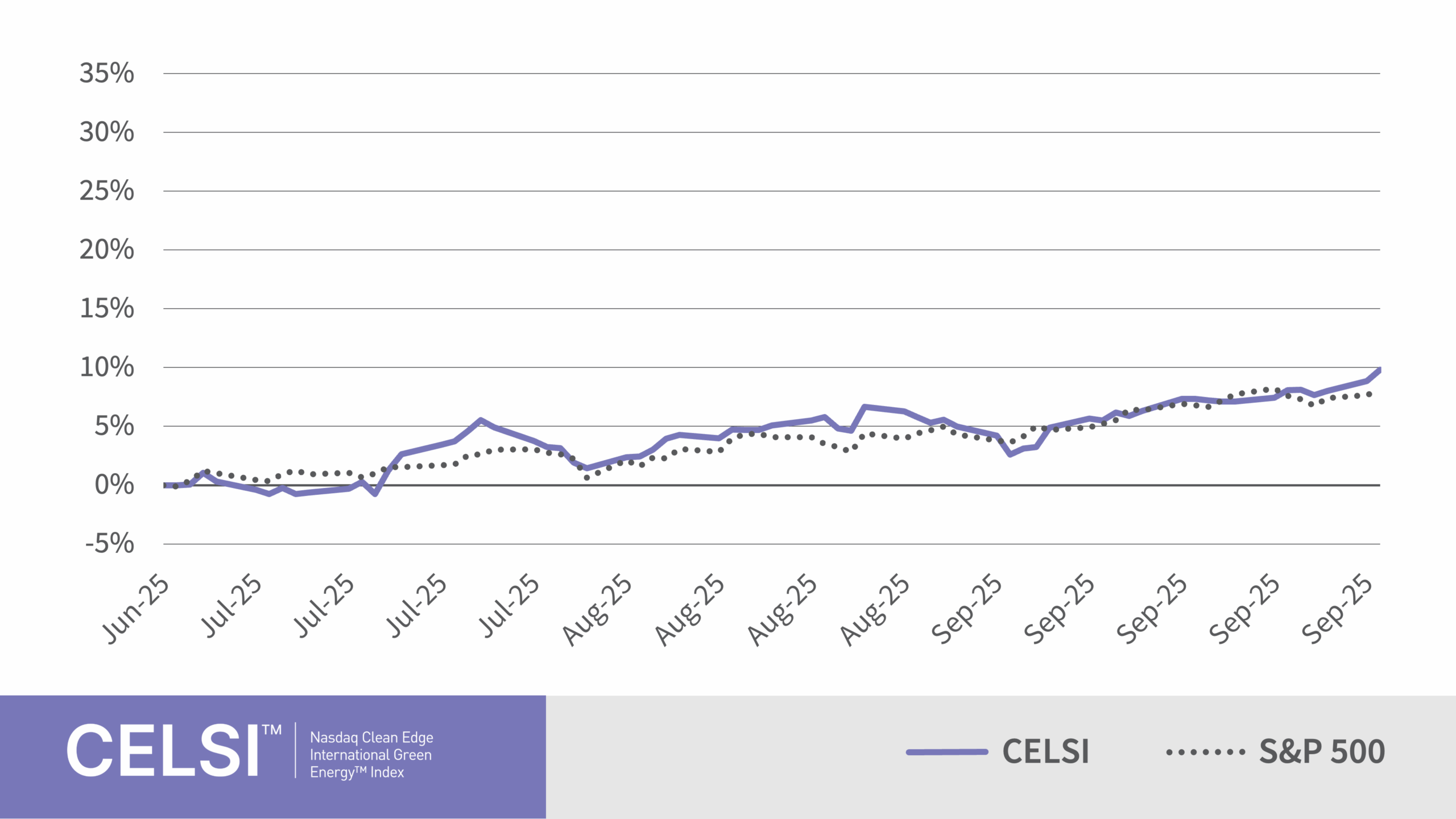

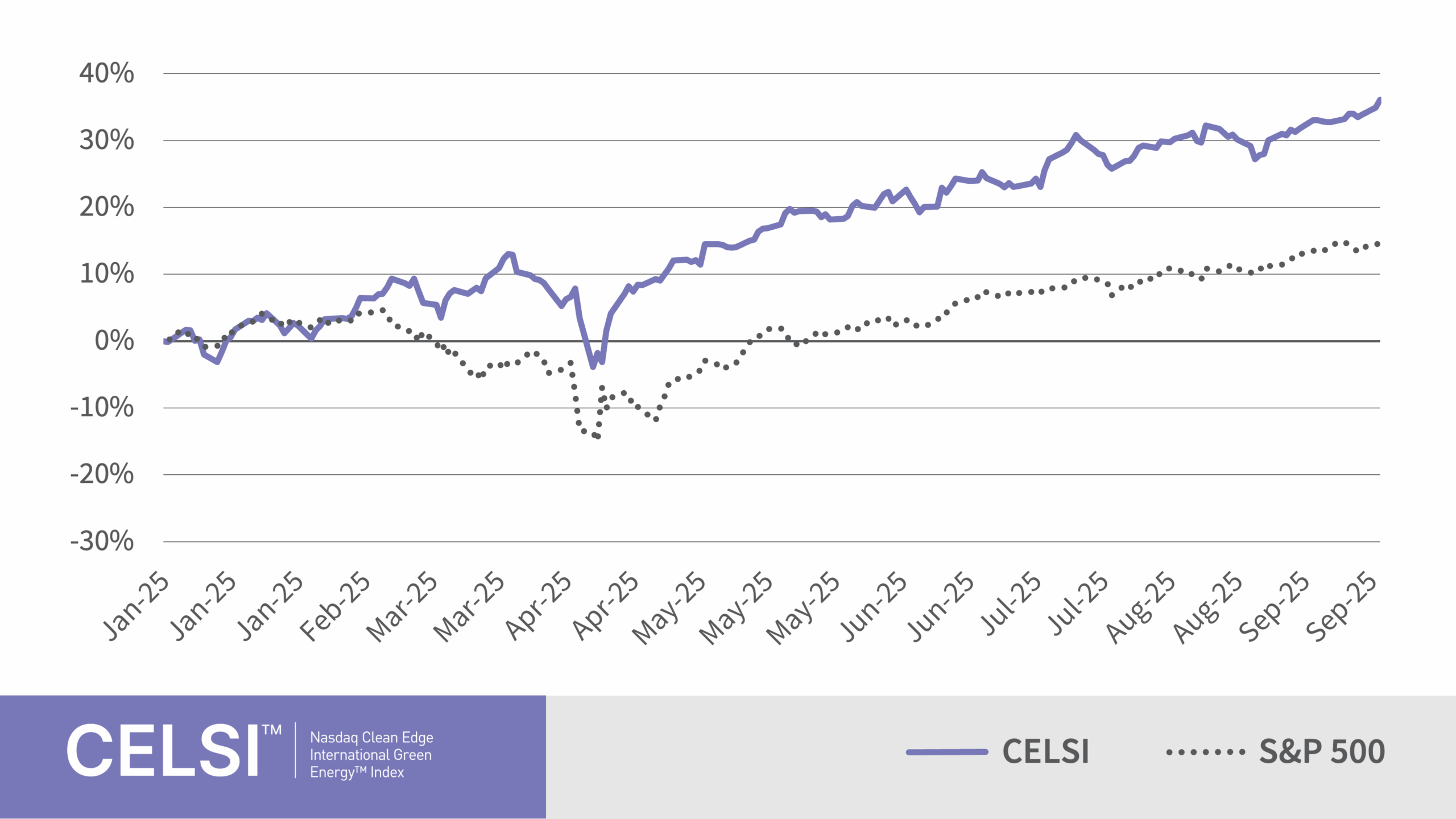

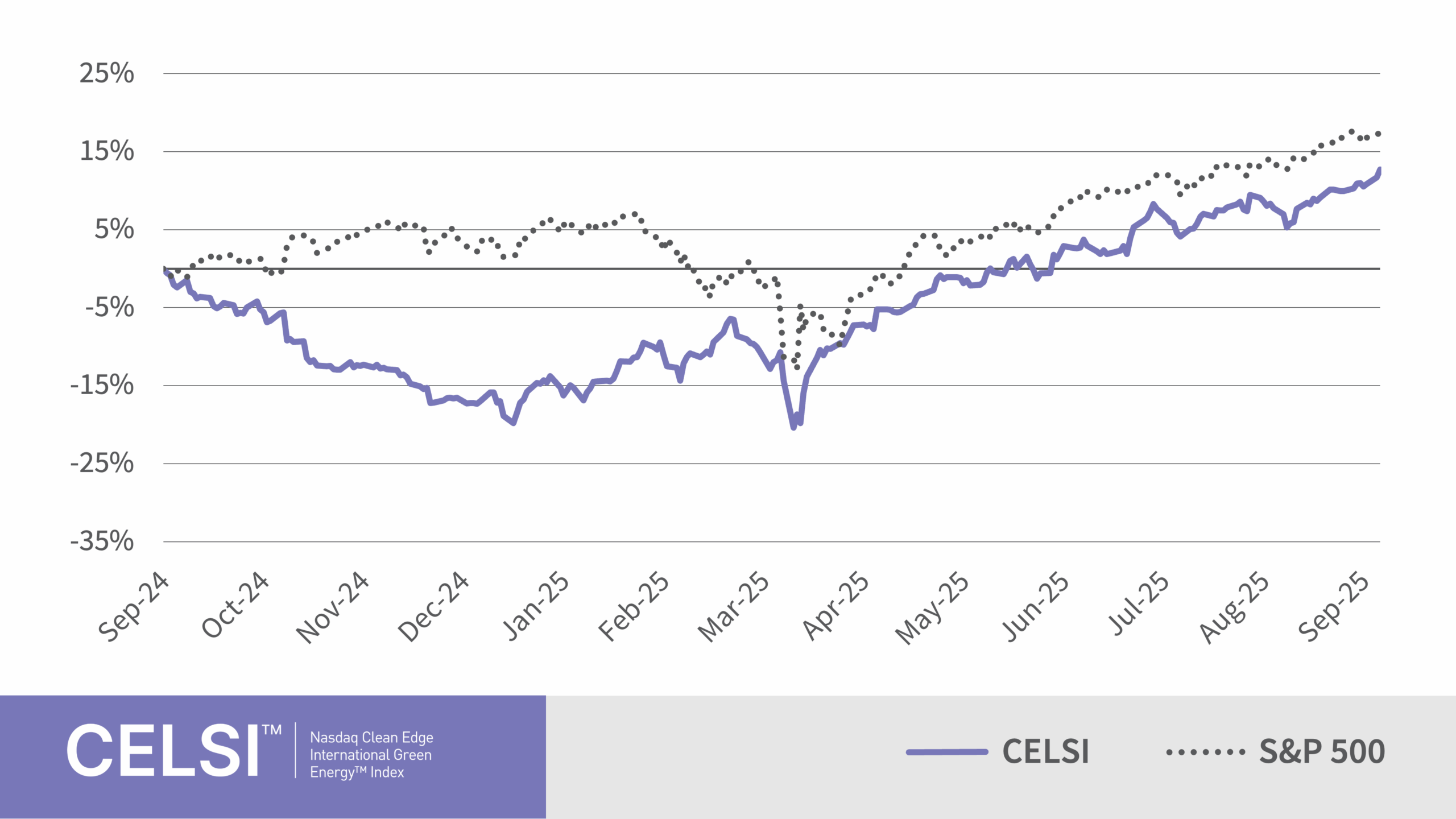

Recent CELSI Index Performance

Total Return Through September 30, 2025

CELSI Methodology

Index Calculation

The Nasdaq Clean Edge International Green Energy Index (CELS) began on January 23, 2021 at a Base Value of 1,000. Click here to learn more.

Eligibility Criteria

A security’s issuer must be classified as a technology manufacturer, developer, distributor, and/or installer in one of the following sub-sectors, as defined by Clean Edge (see complete list of index screens by clicking on the Methodology link below):

- Energy Intelligence (EI) – conservation of energy, increasing efficiency, energy and power management systems and controls, LEDs, superconductors, etc.;

- Renewable Energy (RE) – solar, wind, geothermal, and low-impact water-power manufacturers, developers, and operators;

- Enabling Materials (EM) – silicon, lithium, bio-based, and/or other materials and processes that enable clean-energy and low-carbon technologies;

- Grid – smart meters, transmission, and distribution, etc.; and

- Energy Storage & Conversion (ES&C) – electric vehicles; advanced batteries; power conversion; hydrogen; fuel cells for stationary, portable and transportation applications; etc.

A security’s issuer must have a demonstrated ability to capture the potential of the clean-energy sector by receiving 50% or more of its revenue from clean-energy and low-carbon activities, or, in the case wherein a constituent has multiple business units and revenue streams, have substantial exposure to the clean-energy and low-carbon sector, as determined by Clean Edge.