No timeline selected.

QGRD Overview

The Nasdaq OMX Clean Edge Smart Grid Infrastructure™ Index (QGRD™) is designed to act as a transparent and liquid benchmark for the smart grid and electric infrastructure sector. The Index includes companies that are primarily engaged and involved in electric grid; electric meters, devices, and networks; energy storage and management; connected mobility; and enabling software used by the smart grid and electric infrastructure sector (including both pure play companies focused on the smart grid sector and diversified multinationals with smart grid sector exposure).

An alternate version of the index, the Nasdaq OMX Clean Edge Smart Grid Infrastructure Exclusions™ Index (QGRDE™), incorporates an ESG screening methodology identified and applied by Morningstar Sustainalytics. Click on the Constituents Sheet to learn more.

See index components and learn more about up-to-date performance, licensed financial products, and our methodologies below.

QGRD Constituents

(Last updated September 2025)

| TICKER | COMPANY NAME | SECTOR | DOMICILE | |

|---|---|---|---|---|

| ABBN | ABB Ltd. | GI + EMD&N | Switzerland | |

| AEIS | Advanced Energy Industries, Inc. | ES&C | USA | |

| 2395 | Advantech Co., Ltd. | ES + EMD&N | Taiwan | |

| AES | AES Corp. | ES&C + GI | USA | |

| ALFEN | Alfen N.V. | EMD&N + GI | Netherlands | |

| 1514 | Allis Electric Co., Ltd. | GI | Taiwan | |

| ALUP11 | Alupar Investimento S.A. | GI | Brazil | |

| AMSC | American Superconductor Corp. | GI | USA | |

| ADI | Analog Devices, Inc. | ES&C | USA | |

| APTV | Aptiv Plc | EMD&N | Ireland |

See All Constituents

| TICKER | COMPANY NAME | SECTOR | DOMICILE |

|---|---|---|---|

| ACA | Arcosa, Inc. | GI | USA |

| ASTOR.E | Astor Enerji A.S. | GI | Turkey |

| ATKR | Atkore, Inc. | GI | USA |

| AZZ | AZZ Inc. | GI | USA |

| BDC | Belden, Inc. | GI | USA |

| BEAN | BELIMO Holding AG | EMD&N | Switzerland |

| BKW | BKW AG | GI + EMD&N | Switzerland |

| 1211 | BYD Co. Ltd. | ES&C | China |

| CENER | Cenergy Holdings S.A. | GI | Belgium |

| EBR | Centrais Elétricas Brasileiras S.A. | GI | Brazil |

| 1513 | Chung-Hsin Electric & Machinery Mfg. Corp. | GI | Taiwan |

| CSCO | Cisco Systems, Inc. | ES | USA |

| CPLE6 | Companhia Paranaense de Energia S.A. (COPEL) | GI | Brazil |

| 3750 | Contemporary Amperex Technology Co., Ltd. | ES&C | China |

| 6622 | Daihen Corporation | GI | Japan |

| DGII | Digi International, Inc. | EMD&N + ES | USA |

| EOAN | E.ON SE | GI + EMD&N | Germany |

| ETN | Eaton Corp. Plc | ES | Ireland |

| EDP | EDP S.A. | GI | Portugal |

| ELI | Elia Group S.A. | GI | Belgium |

| EMR | Emerson Electric Co. | ES | USA |

| ENEL | Enel S.p.A. | GI + EMD&N | Italy |

| ENGI11 | Energisa S.A. | GI | Brazil |

| ENS | EnerSys | ES&C | USA |

| ENGI | ENGIE S.A. | GI + ES&C | France |

| ENPH | Enphase Energy, Inc. | ES&C | USA |

| EQTL3 | Equatorial S.A. | GI | Brazil |

| ESE | ESCO Technologies, Inc. | EMD&N | USA |

| FLNC | Fluence Energy, Inc. | ES&C | USA |

| FTS | Fortis, Inc. | GI | Canada |

| 1519 | Fortune Electric Co., Ltd. | GI | Taiwan |

| GEV | GE Vernova, Inc. | EMD&N | USA |

| GNRC | Generac Holdings, Inc. | ES&C | USA |

| 6674 | GS Yuasa Corp. | ES&C | Japan |

| HPS.A | Hammond Power Solutions, Inc. | GI | Canada |

| 267260 | HD Hyundai Electric | GI | Korea |

| 6501 | Hitachi, Ltd. | EMD&N + GI | Japan |

| HON | Honeywell International, Inc. | EMD&N + GI | USA |

| HUBB | Hubbell, Inc. | GI | USA |

| H | Hydro One Ltd. | GI | Canada |

| 298040 | Hyosung Heavy Industries Corp. | GI | Korea |

| IBE | Iberdrola S.A. | GI | Spain |

| 103590 | Iljin Electric Co., Ltd. | GI | Korea |

| IFX | Infineon Technologies AG | EMD&N | Germany |

| IBM | International Business Machines Corp. | ES | USA |

| ISAE4 | Isa Energia Brasil S.A. | GI | Brazil |

| ITRI | Itron, Inc. | EMD&N + ES | USA |

| JCI | Johnson Controls International Plc | EMD&N + ES | Ireland |

| LAND | Landis+Gyr Group AG | EMD&N + ES | Switzerland |

| LR | Legrand S.A. | EMD&N | France |

| LFUS | Littelfuse, Inc. | GI | USA |

| 229640 | LS Eco Energy Ltd. | GI | Korea |

| 010120 | LS Electric Co., Ltd. | GI | Korea |

| MTZ | MasTec, Inc. | GI | USA |

| 6508 | Meidensha Corp. | GI + EMD&N | Japan |

| 6503 | Mitsubishi Electric Corp. | GI + EMD&N | Japan |

| MYRG | MYR Group, Inc. | GI | USA |

| NG | National Grid Plc | GI | UK |

| NEX | Nexans S.A. | GI | France |

| 5333 | NGK Insulators, Ltd. | GI | Japan |

| NKT | NKT A/S | GI | Denmark |

| NVT | nVent Electric Plc | GI + ES&C | UK |

| NVDA | NVIDIA Corp. | EMD&N | USA |

| NXPI | NXP Semiconductors N.V. | EMD&N | USA |

| ORCL | Oracle Corp. | ES | USA |

| 6644 | Osaki Electric Co., Ltd. | EMD&N | Japan |

| 6752 | Panasonic Holdings Corp. | ES&C | Japan |

| PLPC | Preformed Line Products Co. | GI | USA |

| PRY | Prysmian S.p.A. | GI | Italy |

| QCOM | QUALCOMM, Inc. | EMD&N | USA |

| PWR | Quanta Services, Inc. | GI | USA |

| RSGN | R&S Group Holding AG | GI | Switzerland |

| RED | Redeia Corporación S.A. | GI | Spain |

| RENE | Redes Energéticas Nacionais S.A. | GI | Portugal |

| 6723 | Renesas Electronics Corp. | EMD&N | Japan |

| 006400 | Samsung SDI Co., Ltd. | ES&C | Korea |

| 062040 | Sanil Electric Co., Ltd. | GI | Korea |

| SAP | SAP SE | ES | Germany |

| SU | Schneider Electric SE | EMD&N + ES | France |

| 1503 | Shihlin Electric & Engineering Corp. | GI | Taiwan |

| SIE | Siemens AG | GI + EMD&N | Germany |

| S92 | SMA Solar Technology AG | ES&C | Germany |

| SEDG | SolarEdge Technologies, Inc. | ES&C | Israel |

| SPIE | SPIE S.A. | GI | France |

| SSE | SSE Plc | GI | UK |

| SJ | Stella-Jones, Inc. | GI | Canada |

| STM | STMicroelectronics N.V. | EMD&N | Switzerland |

| 5802 | Sumitomo Electric Industries, Ltd. | GI | Japan |

| 1609 | Ta Ya Electric Wire & Cable Co., Ltd. | GI | Taiwan |

| 001440 | Taihan Cable & Solution Co., Ltd. | GI | Korea |

| 6617 | Takaoka Toko Co., Ltd. | EMD&N | Japan |

| TRN | TERNA S.p.A. | GI | Italy |

| TSLA | Tesla, Inc. | ES&C | USA |

| TXN | Texas Instruments Inc. | EMD&N | USA |

| TAEE11 | Transmissora Aliança de Energia Elétrica S.A. (TAESA) | GI | Brazil |

| TRMB | Trimble, Inc. | ES | USA |

| VMI | Valmont Industries, Inc. | GI | USA |

| VER | Verbund AG | GI | Austria |

| 6409 | Voltronic Power Technology Corp. | ES&C | Taiwan |

| 3393 | Wasion Holdings Ltd. | EMD&N | Hong Kong |

| WEGE3 | WEG S.A. | GI | Brazil |

| WCC | WESCO International, Inc. | EMD&N + GI | USA |

| WLDN | Willdan Group, Inc. | ES | USA |

Licensed Financial Products

Linked products include the following.

| NAME | SYMBOL | SPONSOR |

|---|---|---|

| First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index Fund | GRID | First Trust Advisors L.P. |

| First Trust Nasdaq Clean Edge Smart Grid Infrastructure UCITS ETF (GRID) | GRDU | First Trust Global Portfolios |

For additional information on licensing opportunities, please contact us.

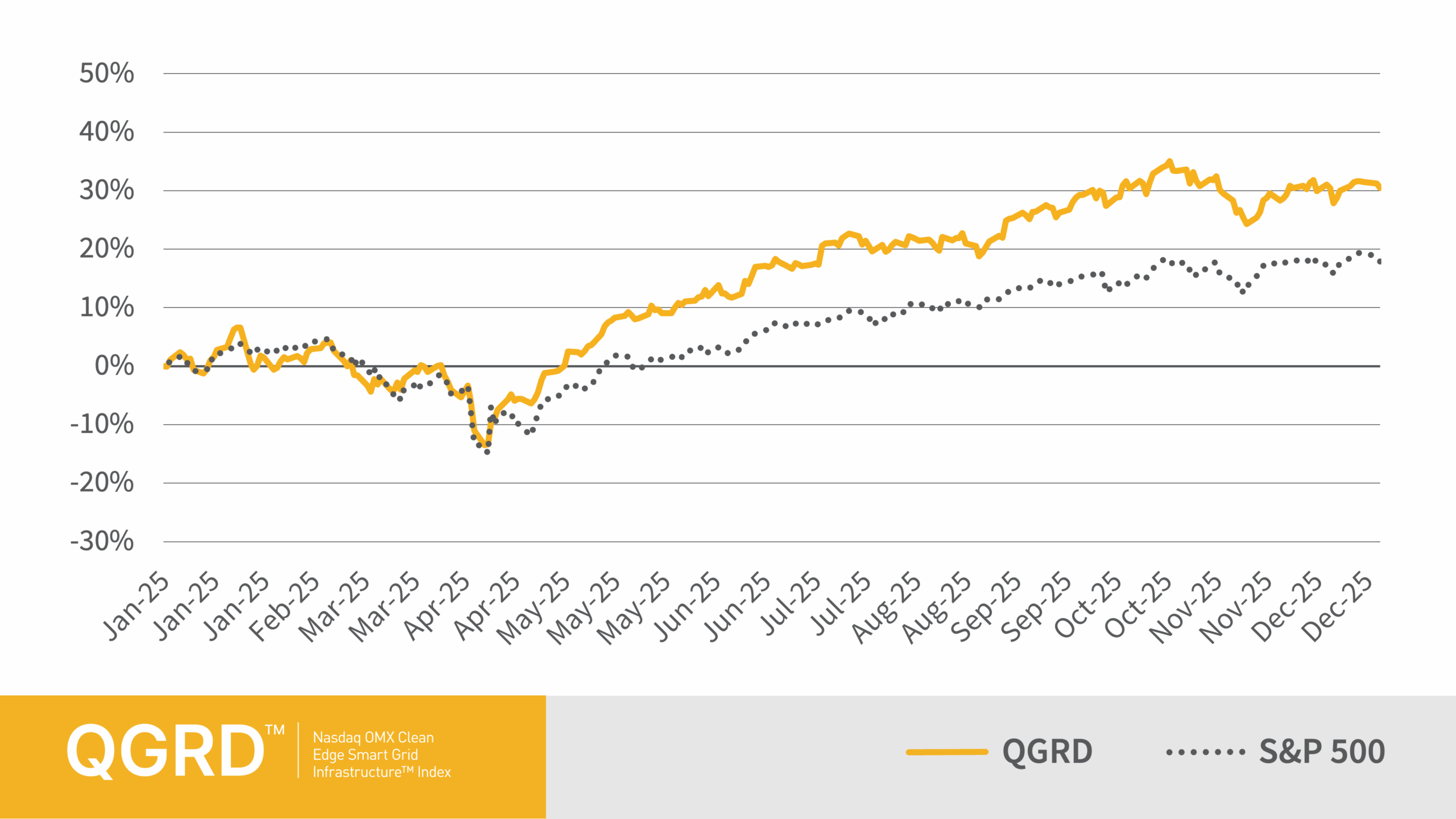

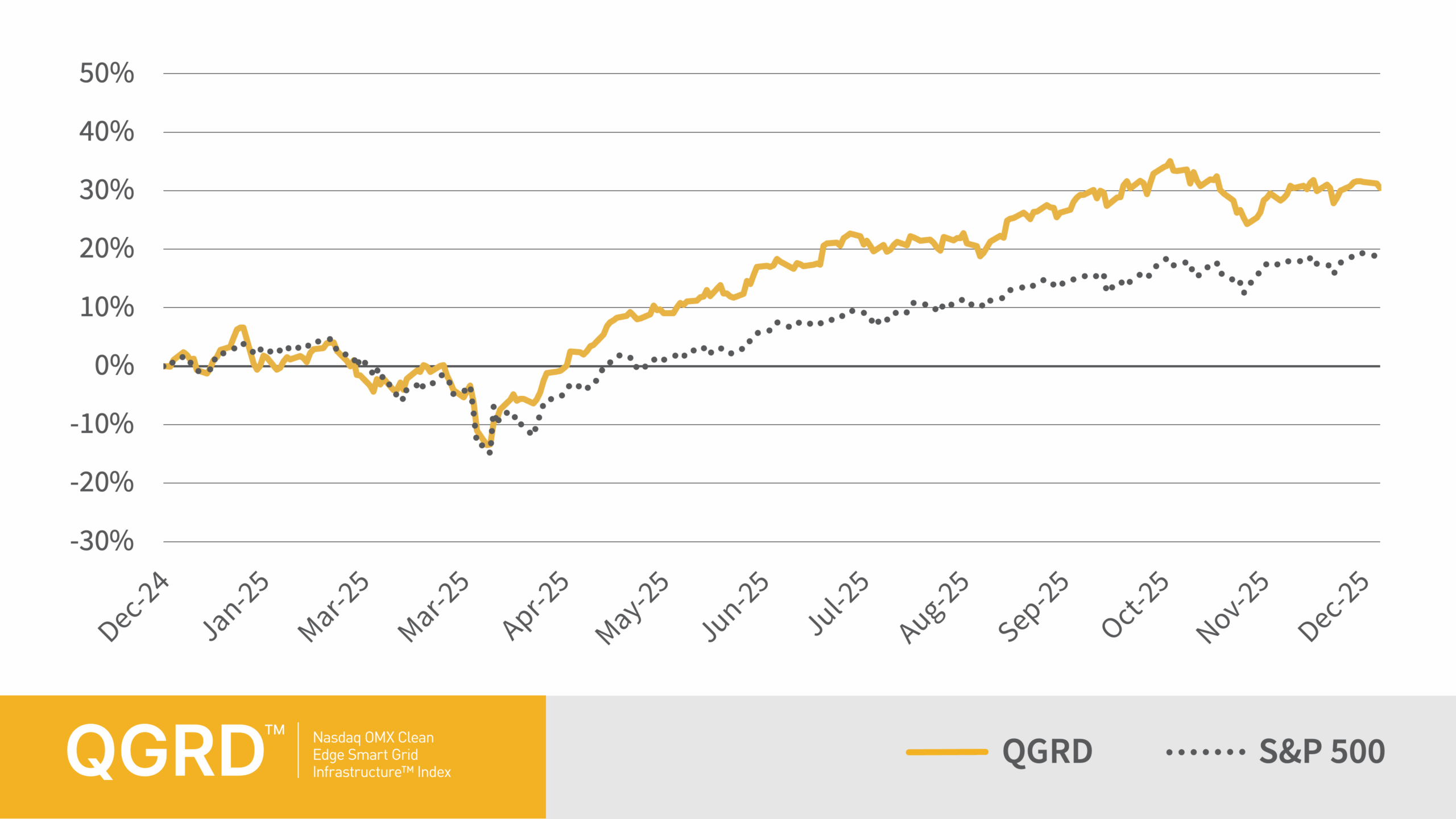

Recent QGRD Index Performance

Total Return Through December 31, 2025

QGRD Methodology

Index Calculation

The Nasdaq OMX Clean Edge Smart Grid Infrastructure Index (QGRD) began on September 22, 2009, at a base value of 250.00. Click here to learn more.

Eligibility Criteria

To be included in the Index, a security must meet the following criteria (see complete list of index screens by clicking on the Detailed Methodology link below):

- the issuer of the security must be classified as a smart grid, electric infrastructure, EV network, smart building, software, and/or other grid-related activities company according to Clean Edge;

- the security must be listed on an index-eligible global stock exchange approved by the Index Administrator

The component securities are classified as Pure Play or Diversified. Pure Play securities are given a collective weight of 80% and the diversified securities are given a collective weight of 20% in the Index.

- Pure Play (must receive a significant portion of revenue from smart grid and grid infrastructure activities)

- Diversified (must have activities that contribute to broader grid modernization and smart grid market)

QGRD is the world’s first exchange-listed index to track smart grid and electric infrastructure companies. Our goal is to act as a transparent and liquid benchmark for companies active in this sector.

Nasdaq OMX Clean Edge Smart Grid Infrastructure Index (QGRD) constituents must pass a rigorous screening test:

- Must be listed on eligible exchange

- Must have a minimum float-adjusted worldwide market capitalization of $100 million

- Must have a minimum three-month average daily dollar trading volume of $500 thousand

- Must pass qualitative criteria established by Clean Edge