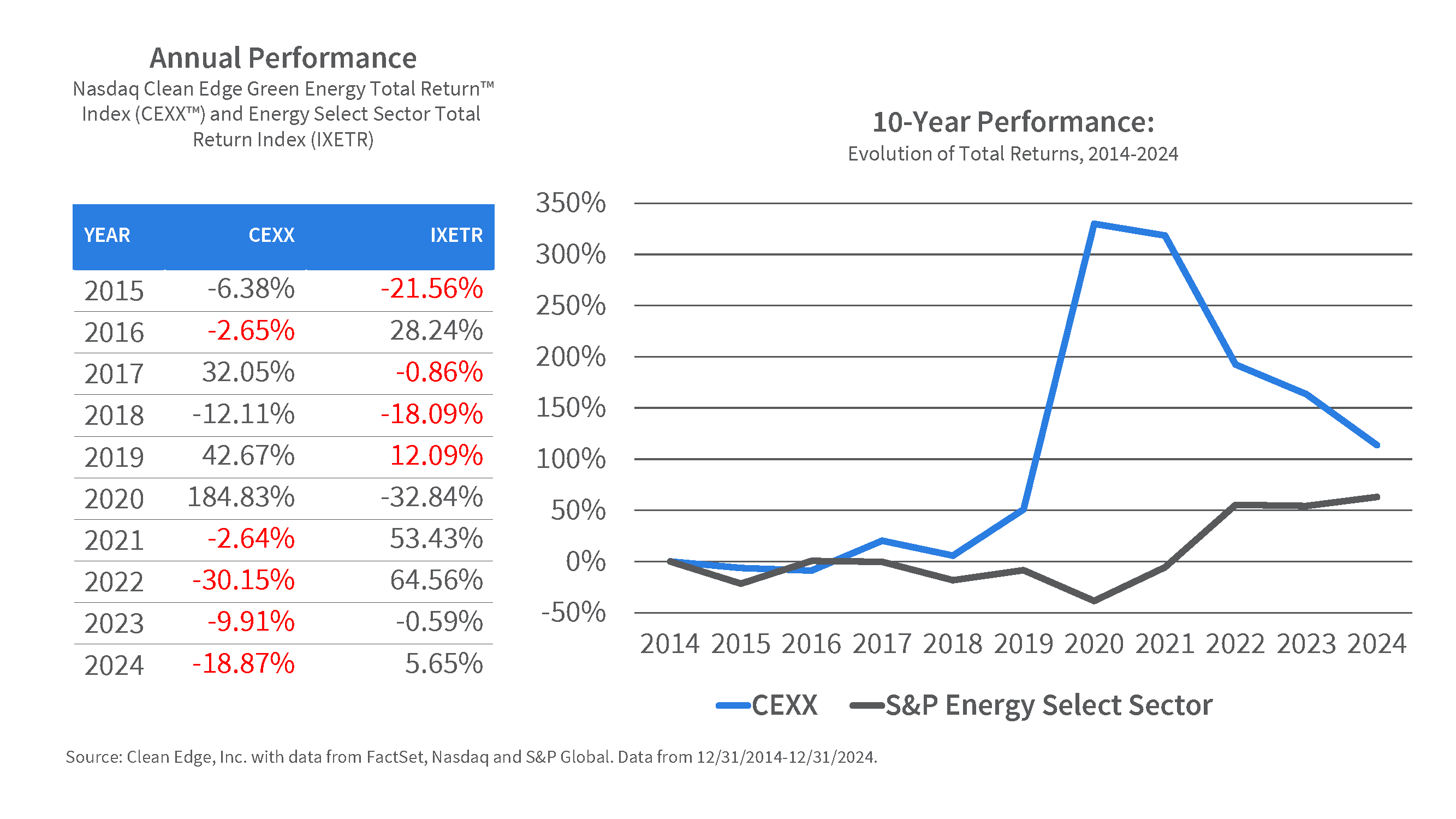

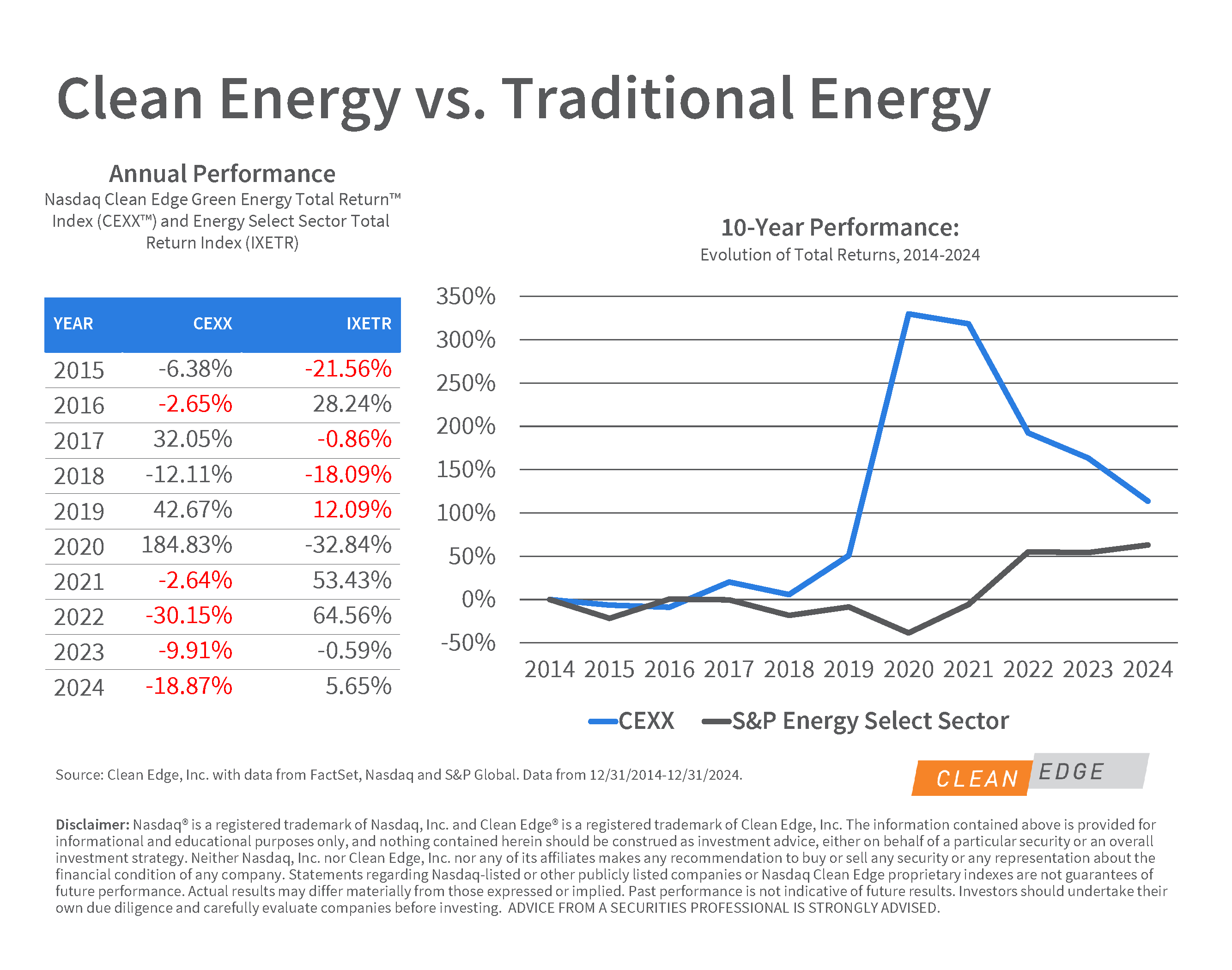

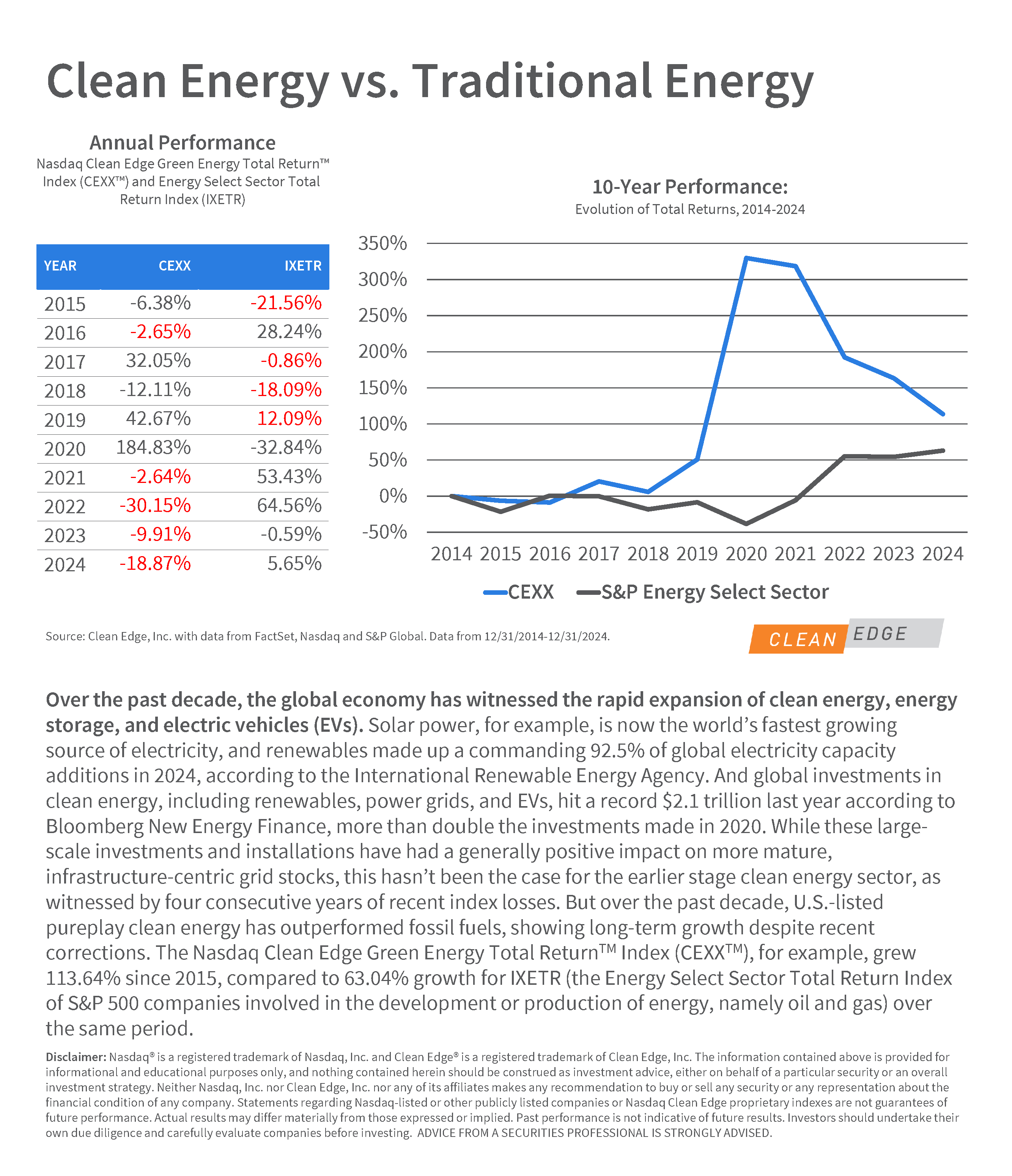

Over the past decade, the global economy has witnessed the rapid expansion of clean energy, energy storage, and electric vehicles (EVs). Solar power, for example, is now the world’s fastest growing source of electricity, and renewables made up a commanding 92.5% of global electricity capacity additions in 2024, according to the International Renewable Energy Agency. And global investments in clean energy, including renewables, power grids, and EVs, hit a record $2.1 trillion last year according to Bloomberg New Energy Finance, more than double the investments made in 2020. While these large-scale investments and installations have had a generally positive impact on more mature, infrastructure-centric grid stocks, this hasn’t been the case for the earlier stage clean energy sector, as witnessed by four consecutive years of recent index losses. But over the past decade, U.S.-listed pureplay clean energy has outperformed fossil fuels, showing long-term growth despite recent corrections. The Nasdaq Clean Edge Green Energy Total Return™ Index (CEXX™), for example, grew 113.64% since 2015, compared to 63.04% growth for IXETR (the Energy Select Sector Total Return Index of S&P 500 companies involved in the development or production of energy, namely oil and gas) over the same period.

Clean Energy vs. Traditional Energy