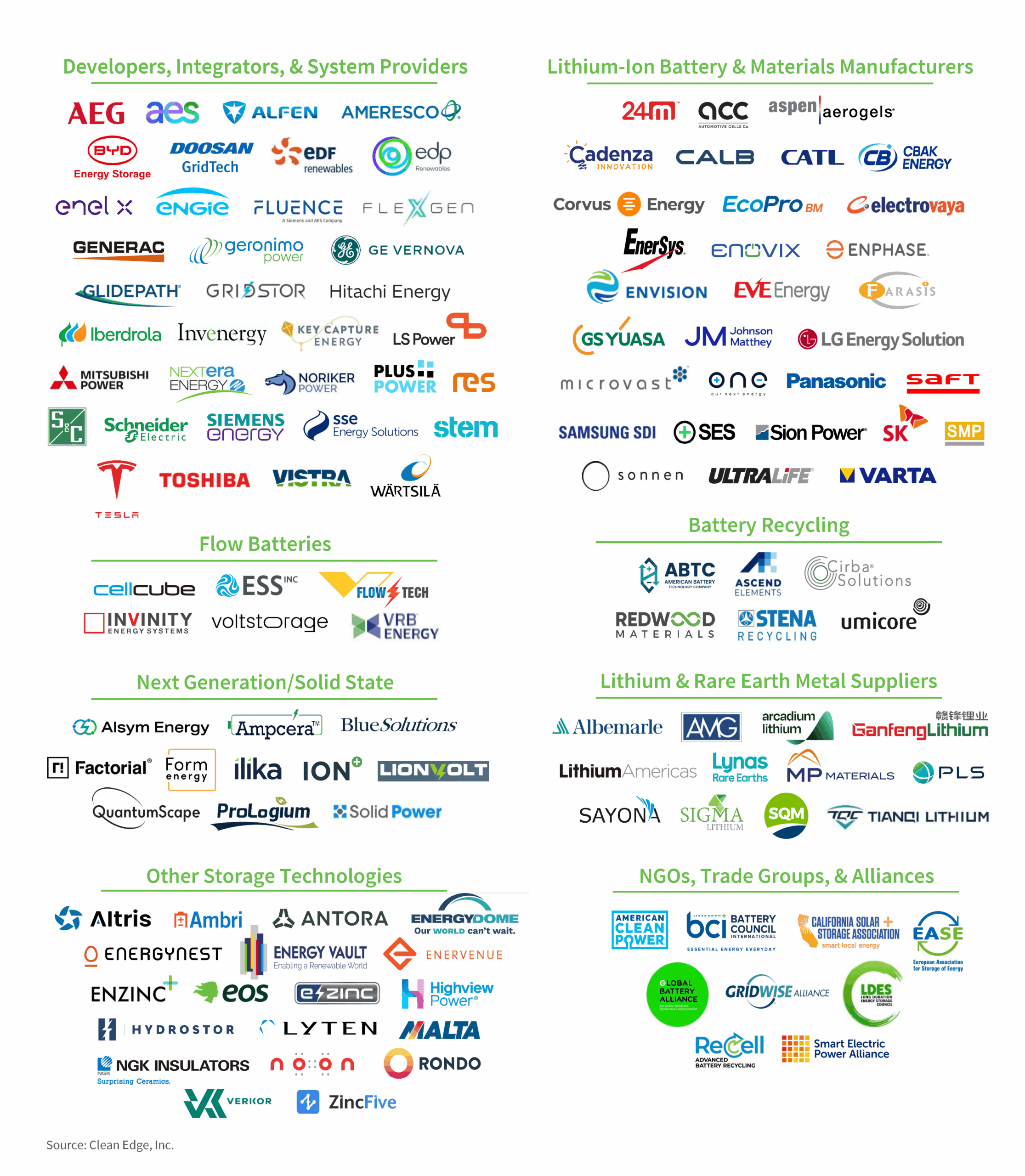

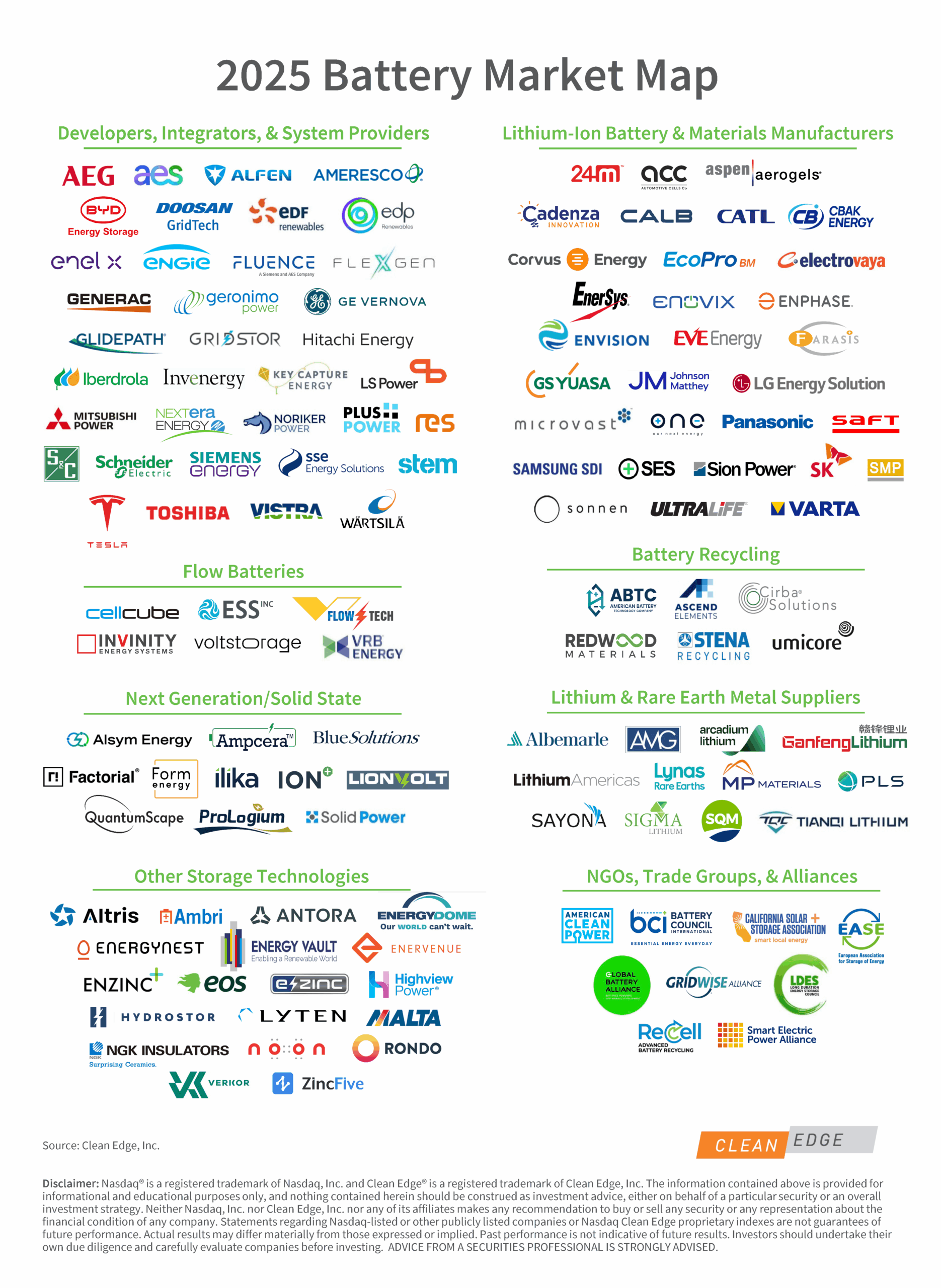

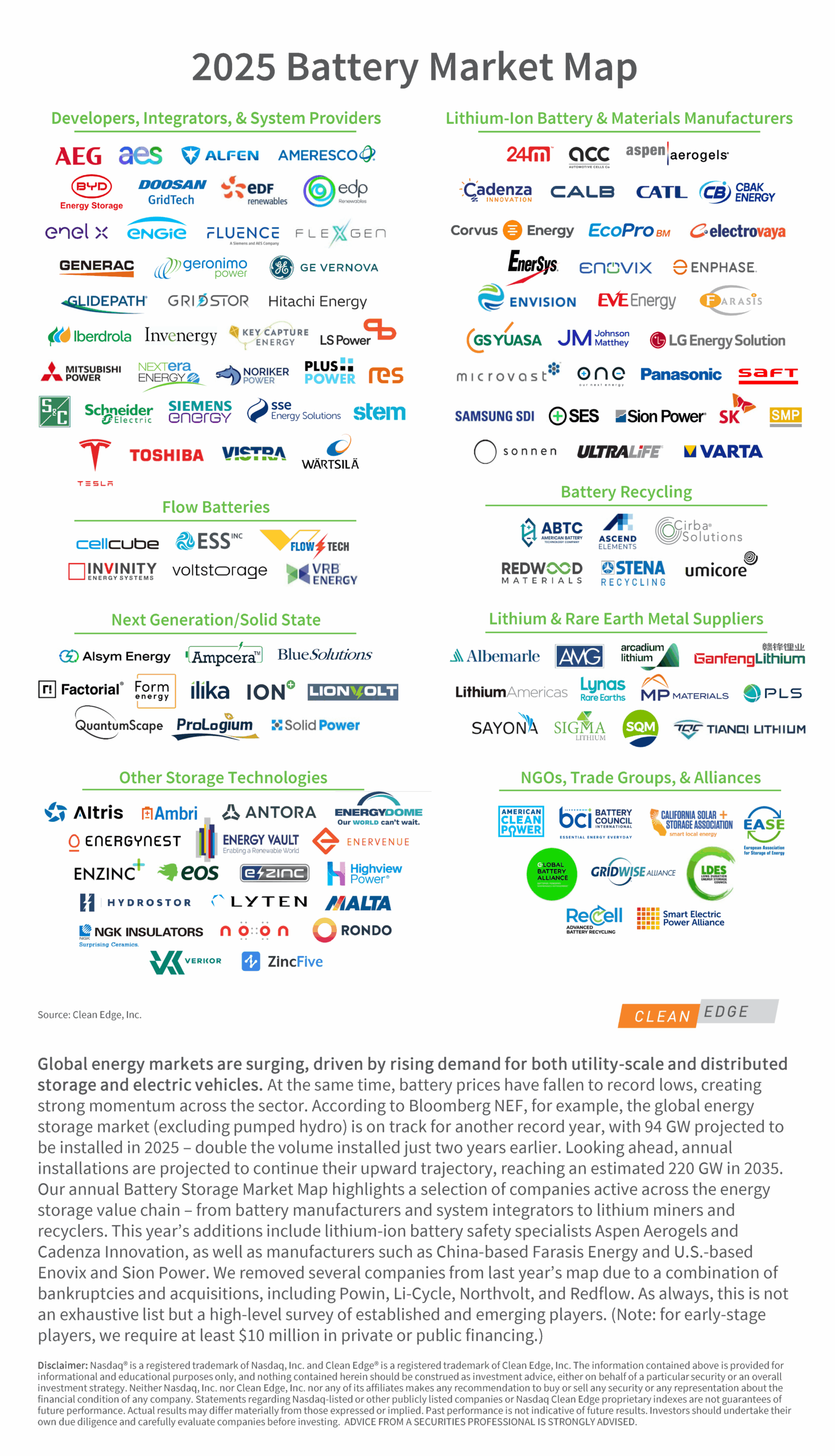

Global energy markets are surging, driven by rising demand for both utility-scale and distributed storage and electric vehicles. At the same time, battery prices have fallen to record lows, creating strong momentum across the sector. According to Bloomberg NEF, for example, the global energy storage market (excluding pumped hydro) is on track for another record year, with 94 GW projected to be installed in 2025 – double the volume installed just two years earlier. Looking ahead, annual installations are projected to continue their upward trajectory, reaching an estimated 220 GW in 2035. Our annual Battery Storage Market Map highlights a selection of companies active across the energy storage value chain – from battery manufacturers and system integrators to lithium miners and recyclers. This year’s additions include lithium-ion battery safety specialists Aspen Aerogels and Cadenza Innovation, as well as manufacturers such as China-based Farasis Energy and U.S.-based Enovix and Sion Power. We removed several companies from last year’s map due to a combination of bankruptcies and acquisitions, including Powin, Li-Cycle, Northvolt, and Redflow. As always, this is not an exhaustive list but a high-level survey of established and emerging players. (Note: for early-stage players, we require at least $10 million in private or public financing.)

2025 Battery Market Map